Not the next Silicon Valley

My hope is that people in Canada reading this will realize that the problem facing us isn’t a lack of anything. Our problem is actually the presence of actively bad things:

Capital Thinking · Issue #770 · View online

Toronto is not the next great startup scene. Neither is Waterloo, or Vancouver, or anywhere in Canada.

I’m sorry that I have to write this. I really am. I want it to work.

But the growing chorus of aspirational claims that “Toronto’s tech ecosystem is growing faster than anywhere else in North America” or “The Toronto-Waterloo corridor is ‘the nice person’s Silicon Valley’” honestly do not portray an accurate picture of what we’ve built here.

Why the Canadian Tech Scene Doesn’t Work

To be clear: I am not saying there are no individual success stories of Canadian startups, or that there are no good angel investors or VCs here, or that there are no individual instances of things going right.

Shopify obviously worked out great, there are other big success stories like Lightspeed making their way up, we have some really good initiatives around bringing new builders into Canada, and there are a good many individually inspiring startups that I admire. There is certainly a lot of something here.

It’s true that big companies are adding tech jobs here; it’s true that there is a lot of activity in the startup scene here. But we do not have a real startup scene that actually works; not yet. You cannot put the Toronto tech scene side by side with the Bay Area’s and say, “These are similar; ours is just smaller.” Come on; it’s not.

The Bay Area’s startup scene continuously pulls incredible companies into existence. Ours… does not do that. The Canadian tech scene, as it currently operates, does not support startups. It stifles them. I’m sure for some of you it’s in your professional interest to insist otherwise, and look I respect that, but I care about us getting this right, and someone needs to say this so it might as well be me.

Angels

There’s no easy place to start. The startup scene is a system, with many interacting parts: Angel and VC money, the peer set of other founders, engineering talent, the set of social norms; everything depends on everything else.

But we have to pick somewhere to start telling this story, and I think the best entry point is to talk about angel investors. I remember back when I was at Social Capital, Jay and I would go visit other cities to check out local startups and university research facilities.

Every time, we’d hear the same refrain from locals:

“We’ve got so many great ingredients for a tech ecosystem here. We’ve got the science and hardcore R&D coming out of the local university system.We’ve got so much engineering talent. And there’s a lot of investment capital available. We’re just missing one thing, and that’s early stage investors.”

Well, yeah. A startup scene needs angels.

Without a source of fast-moving, pre-institutional capital, it’s hard to pull off a cold-start when you’re first funding a project. But you know what’s even worse than no angel investors?

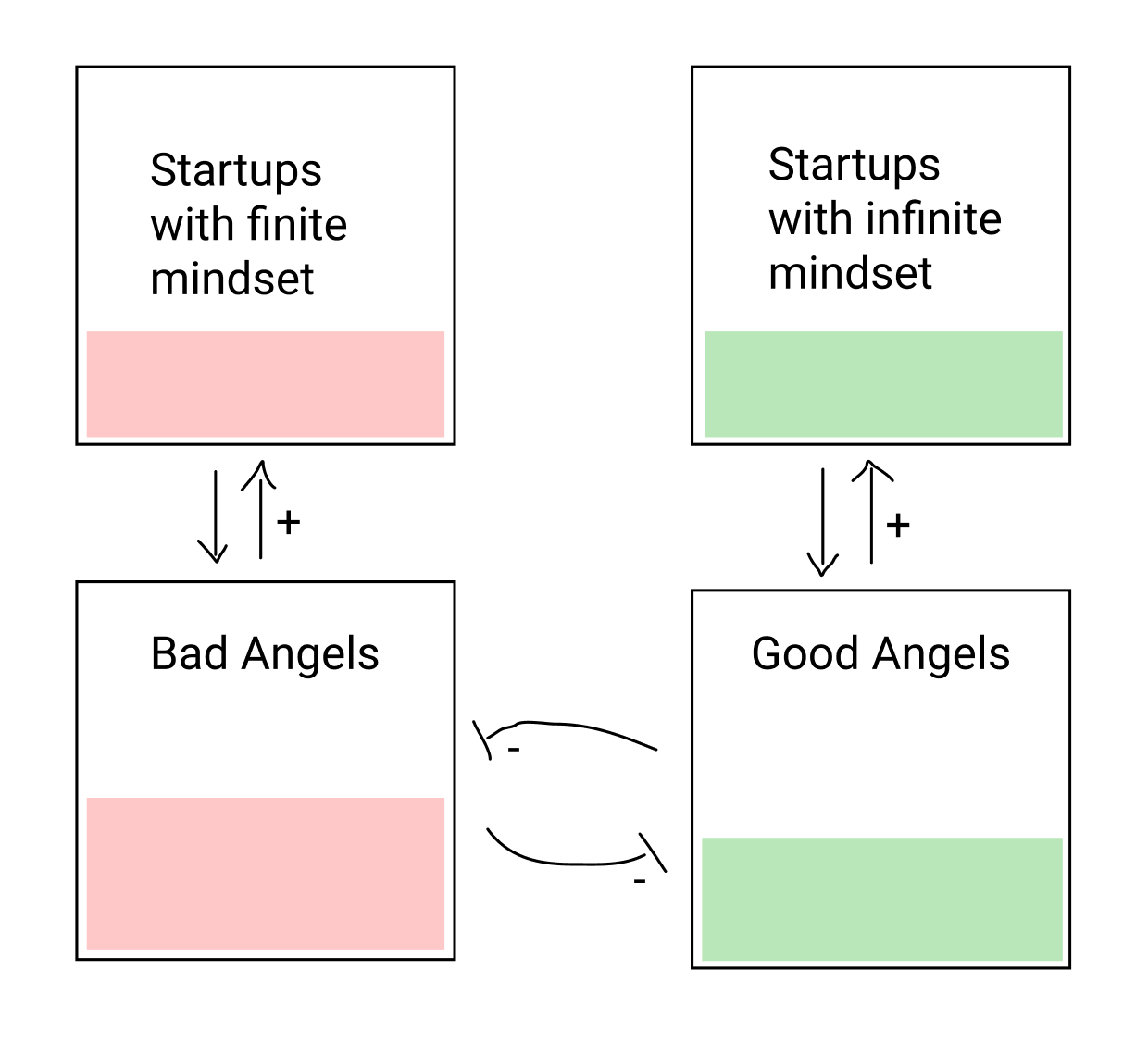

Having bad angel investors. In order to understand the difference between Good and Bad angels, I think it’s helpful to have a quick understanding of Finite and Infinite Games, by James P Carse.

This book introduces a simple but profound idea about there being two fundamental kinds of “games”, or multiplayer activities, that we engage in as people:

First, finite games are played for the purpose of winning.

Whenever you’re engaging in an activity that’s definite, bounded, and where the game can be completed by mutual agreement of all the players, then that’s a finite game.

Much of human activity is described in finite game metaphors: wars, politics, sports, whatever. When you’re playing finite games, each action you take is directed towards a pre-established goal, which is to win.

In contrast, infinite games are played for the purpose of continuing to play.

You do not “win” infinite games; these are activities like learning, culture, community, or any exploration with no defined set of rules nor any pre-agreed-upon conditions for completion.

The point of playing is to bring new players into the game, so they can play too. You never “win”, the play just gets more and more rewarding. Good Angels are playing an infinite game.

They are contributing to a community; not in order to win something definite, but to earn the right to keep participating in the scene. They play the infinite game of growing their status within a growing community, which is a very good thing.

And they often make a ton of money, leading to the perplexing advice for outsiders: “the way to make money angel investing is to not set out trying to make money.”

Bad Angels are playing a finite game. They are trying to win something. There are two kinds of Bad Angels. The first kind are literally in it for the money: they want to see financial returns in a reasonable period of time, and push their founders to run their startups as an investment, like real estate.

The second kind is more subtle: they’re Angels who’re doing it for the satisfaction and the status, but only among their own, closed peer set. They are competing for zero-sum bragging rights, not working to grow the community. Bad angels waste founders’ time a lot.

They’re always asking for something; either for P&Ls and business plans, or suggesting introductions that are clearly for the Angel’s social benefit rather than for the founder’s.

Bad Angels care a lot about milestones. (More on this later.) You see these sorts of Angel investing clubs or societies on the east coast a lot. Canada has them too. Good Angels have an entirely different attitude about…

*Featured Photo credit: Guillaume Jaillet on Unsplash