The Missing Messy Middle

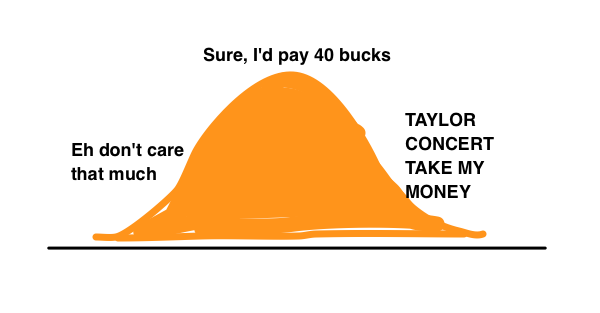

The normal distribution is disappearing: we’re in a new world where either you care about something, or you don’t. The middle ground is vanishing.

Capital Thinking · Issue #776 · View online

There’s a classic exercise that we often encounter in business school, or elsewhere in higher education:

the professor proposes, “I have two tickets to the Taylor Swift concert this Saturday night. All of you should write down on a piece of paper the maximum amount they’d be willing to pay for these tickets, then turn them in, and we’ll look at the distribution of those prices.”

The idea is that from there, a promoter should be able to determine the optimal price (or sets of prices) to charge in order to maximize their sales.

Taylor Swift, iOS, and the Access Economy: Why the Normal Distribution is Vanishing

Now, what typically happens is we see a distribution of numbers get passed in. Some are willing to pay lots, others not so much, and a bunch of people lie somewhere in the middle.

We often see these numbers form something like a Gaussian distribution, or as it’s known to the general public, a ‘Normal Distribution’.

Why do we see this distribution a lot? And why is it called ‘Normal’?

(Editor’s note: I play fast and loose here with what a ‘Normal’ distribution technically means here. If you’re mathematically inclined, kindly replace the words Normal and Gaussian with ‘Unscientific Lumpy Middle’ and the points should still hold just fine.)

We see this distribution all over the place: in nature, in business, in life. If you’ve taken high school biology, you’ve probably encountered this picture:

There’s a good reason why the normal distribution pops up so much: it represents the sum of some number of component factors.

If you’ve played the game Settlers of Catan, you’ll be very familiar with this phenomenon: the outcome of the total roll of the dice, which represents the sum of one die plus the other, follows an approximately normal distribution.

If you were rolling five dice instead of two (like in Yahtzee), you’d see this distribution more clearly. If you’re dealing with hundreds or thousands of factors (like human genes), you see normal distributions arise for things like our height.

Even when some of these factor are inter-dependent, as is certainly the case with our genetics, we still reliably encounter these distributions: whenever we encounter the sum of many factors, there they are:

It should make sense that our stated prices for these Taylor Swift tickets should follow a distribution like this: you could think of it as a sum of many factors.

How much did you like 1989? How much disposable income do you have? How far would you have to travel? What are your other options? Would you have friends who would go with you? And so forth.

We can generalize this example to our preferences and choices generally: the decisions we make whenever we spend something (money, time, opportunity, etc) represent the sum of many factors.

Suppose you’re shopping for a new car: the distribution of new car prices aren’t quite symmetrically Gaussian (there’s a long tail towards the high end), but it’s still Normal-ish.

If you’re looking for a car as a young person, you’ll have a certain set of factors you consider – cost, value, practicality, style. As you grow up, these factors will change, but the decision will remain multifactorial in nature – many of your preferences will evolve, but along a similar set of variables.

Some of us buy luxury cars, others buy the cheapest that they can, and most of us are in the big fat middle – like rolling two dice and landing somewhere between a 4 and a 10. It won’t happen every time, but it’ll happen most of the time.

There’s just one problem with this principle: it’s vanishing.

Consider these three situations:

1. You’re looking to buy a new smartphone. What does your demand distribution look like? Is it normally distributed? Absolutely not. It looks like this:

Chances are good that if you’re in the market for a smartphone, you fall into one of two very clear cut categories.

Either:

a. you’ve decided that your new phone is a very important item in your life, so you’re going to buy the nicest phone available at whatever price. (Usually this means an iPhone, although some flagship Android phones qualify for this category.)Or,

b. you’ve decided that just about every phone out there is ‘good enough’ and is more than adequate for your needs, so you’ll go with whatever one costs $0 with your existing wireless contract.

2. You have twenty minutes of free time to spend reading things on the internet. How will you choose to allocate your attention? Odds are, it looks like this:

Chances are good that your next twenty minutes will fall into one of two categories.

Either:

a. you go to a very specific destination site that you had in mind, with content that you will not find anywhere else and that you know exactly where to find.This could be a high-end news source like the New York Times; it could also be a small, niche site like Stratechery. But either way they’re a destination site – you’ve chosen explicitly that they, and precisely they, are what you’re going to read.

Or,

b. you don’t choose anything at all; instead you head to Facebook, Twitter, Reddit, etc and just browse through whatever’s posted there. Often it’s content with broad, mass appeal like Buzzfeed or Vox that no one is looking for directly, but many are happy to click and read.

3. You’re a recent college graduate trying to decide where you’ll live. How will you make this decision? Will your options and preferences be normally distributed? Probably not. Odds are, your decision looks like this:

Chances are good that your decision will fall into one of two categories.Either:

a. you’re trying to break into the film industry, so you’re overwhelmingly drawn towards LA.

Or you’re trying to join a tech startup, so might be drawn to the Bay area.

Or for any number of reasons. you just have to live in New York. And you’re willing to put up with all kinds of horrible side effects in order to live in that exact right place.

Or,

b. You will move anywhere where you get a job, or get into grad school, or where your girlfriend is moving – it’s effectively a single-variable decision.These aren’t normal distributions at all.

They’re totally different – they’re bifurcated distributions where one factor is dominating over all of the other factors. Either you care about X, or you don’t. Either you care about Y, or you don’t.

And what used to be the happy middle – the fat part of the normal distribution, where most of the demand is supposed to lie – is all of a sudden quite sparse. The world seems to be steadily moving in this direction: from one where our demands and preferences are normally distributed to one dominated by these weird, bifurcated, two-tier balances.

Why is this happening?

My hunch is this:

The world’s shift from Normal, Gaussian distributions of demand towards bifurcated, two-tiered distributions is a natural consequence of our shift from a world governed by scarcity to one governed by abundance.

In a world governed by scarcity – which is the one we’re used to thinking about, and the one described in our economics textbooks – it makes complete sense for our purchasing and preferences to be multi-factor considerations with normally distributed outcomes.

This is because when X is scarce, our default position towards X is ‘potentially interested, if the price / conditions are right’. We consider many factors when determining whether conditions are right, so our preferences and decisions are multifactorial in nature – that’s why we see normal distributions so consistently.

But in a world governed by abundance, it’s all different.

When X is abundantly available in many different places and forms, our default position towards any given X is ‘not interested’ unless something specific changes our minds.

These aren’t multifactorial decisions – they’re usually dominated by one single factor whose influence trumps everything else.

If you care about your smartphone, you’re going to get the nicest one; if you don’t, you’re going to get the cheap one.

If you have something specific you want to read, you’re going to read exactly that; otherwise, you’re just going to scroll through Facebook and read whatever.

If you care about living in New York, you’re probably ready to make a lot of concessions in order to live there; if you don’t, then there’s no chance.

If you’re a Taylor Swift fan, you’re probably willing to pay a lot of money for those tickets; if you aren’t, then there’s a good chance you aren’t willing to pay any money for them because even if they were free, you’d rather do something else on Saturday night anyway.

The normal distribution is disappearing: we’re in a new world where either you care about something, or you don’t. The middle ground is vanishing.

So what can we do with this idea?

*Featured post image credit: Alex Danco