Mortgage Rates: How High Can They Go

The good news for the homebuilders is activity usually picks up quickly following an interest rate induced slowdown (as opposed to following the housing bust when the recovery took many years)

Capital Thinking • Issue #1139 • View online

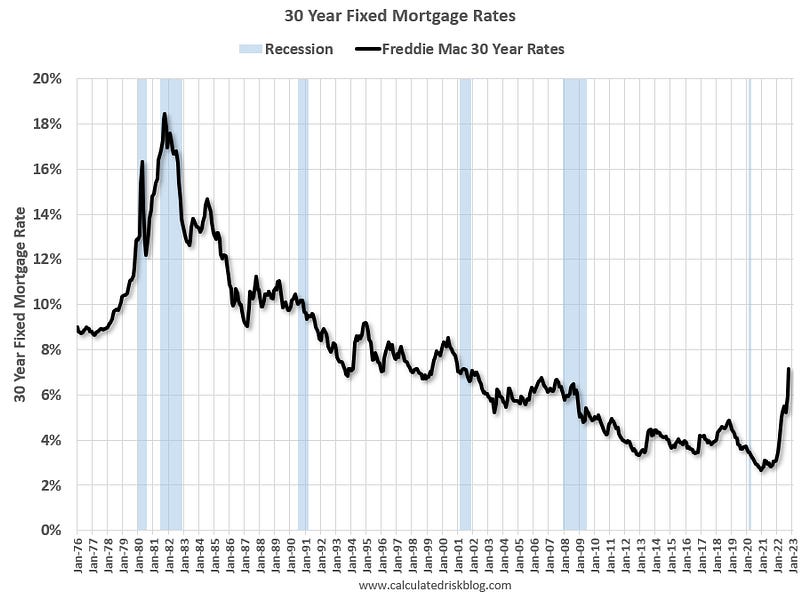

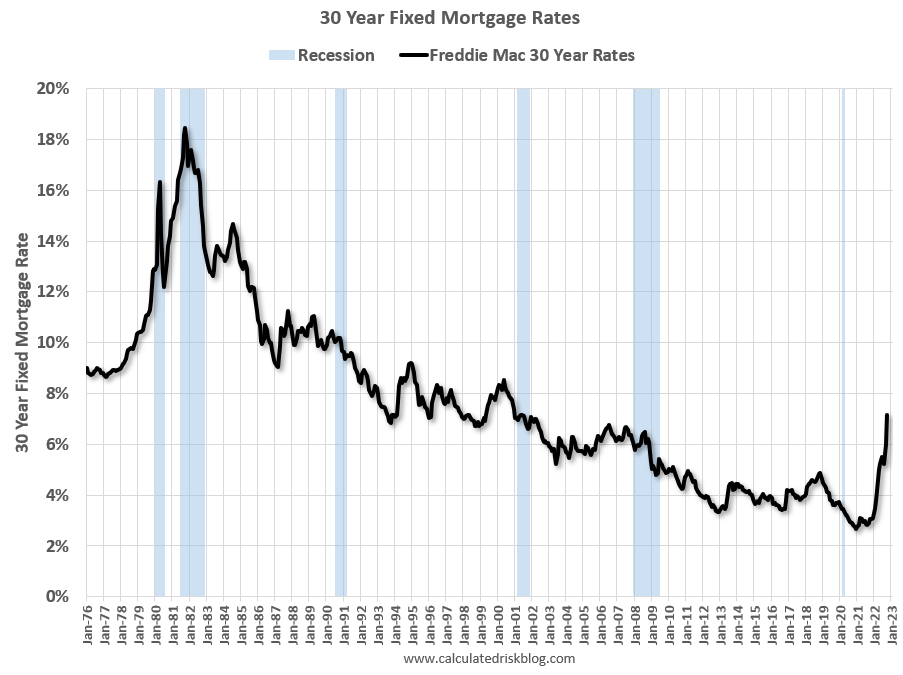

Last Friday, the average 30-year mortgage rate hit 6.7% for zero points and top tier scenarios according to MortgageNewsDaily.

This was the highest rate in 20 years.

Monthly Mortgage Payments Up Record Year-over-year

New Homes sales and Single Family Starts to Fall Further

CalculatedRisk by Bill McBride:

Here is a graph showing the 30-year rate using Freddie Mac PMMS, and MND for last week.

Yes, rates were much higher in the 1980 period, but it is the change in monthly payments that impacts housing.

Monthly payments include principal, interest, taxes, insurance (PITI), and sometimes HOA fees (Homeowners Association). We could also include maintenance, utilities and other costs.

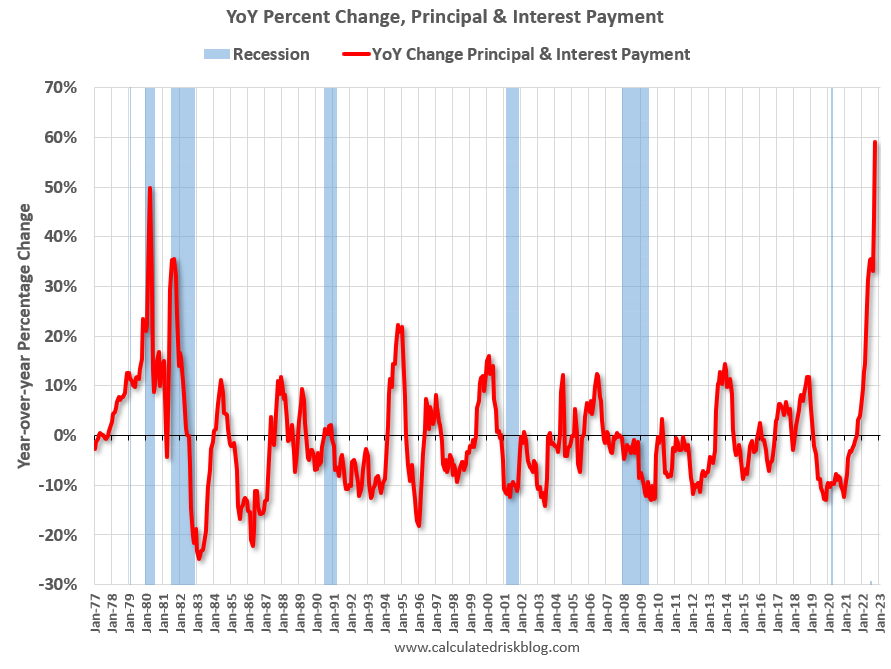

The following graph shows the year-over-year change in principal & interest (P&I) assuming a fixed loan amount since 1977.

Currently P&I is up about 59% year-over-year for a fixed amount (this doesn’t take into account the change in house prices).

This is above the previous record increase of 50% in 1980. This assumed a fixed loan amount - if we add in the year-over-year increase in house prices, payments would be up over 70% YoY for the same house.

This is one of the reasons I've argued Housing: Don't Compare the Current Housing Boom to the Bubble and Bust, Look instead at the 1978 to 1982 period for lessons.