You never know

Imagine: a commercial real estate play, with properties around the world, configured as flexible office space, rentable by the hour, the day, or the month, with great community spaces, aspirational design, and strong tech. In sum, We might Work.

Capital Thinking · Issue #820 · View online

Real estate is an awesome gig.

-Scott Galloway

We (might) Work

Scott Galloway | No Mercy, No Malice:

For starters, the supply of fertile land (urban centers) is finite, but the source of demand keeps growing (more people/capital moving to cities). On top of that, we’ve granted real estate development such favorable tax treatment that it is nearly immune from taxation.

Even Donald Trump, arguably the worst business person in U.S. history, made money in real estate development, despite the serial failure of the underlying business.

As one tax law expert put it, the real estate industry “thinks of the tax code as a basket of goodies to feast on rather than a financial obligation of doing business.” Imagine buying stock and being able to depreciate it as it increased in value.

Thanks to ever-growing demand and favorable tax treatment, real estate once minted more billionaires than tech. In 2019, 223 people on the Forbes billionaire list owed their wealth to real estate, compared to 214 from tech.

Then … Covid.

The third great conveyance of the modern economy (the first two being globalization and digitization) is in full swing: Dispersion, the process of value leapfrogging traditional points of distribution.

Three sectors stand to register the greatest reallocation of stakeholder value (i.e., shit-kicking): healthcare, commercial real estate, and education as consumers leapfrog hospitals, HQ, and campuses.

Dispersion is enabled by both globalization and digitization. High-bandwidth communications link billions of people, and robust mobile devices render that network continuous. Now, blockchain technology is enabling the network to store value (bitcoin) and act on it (ethereum).

This will bring further disruption to industries low on IQ and heavy on EQ, such as insurance/asset management/central banking (wrapping my head around this is my biggest challenge for 2021).

The point is, the pandemic has accelerated all of these trends.

A year-plus of forced acceptance of remote services in every sector has carved permanent change into our behavior. And, few sectors have seen a more radical transformation than office work.

Valuation

Any discussion of valuation must be set against the backdrop of a firm’s valuation.

Gannett Co., Inc. faces structural challenges, but at a $2.5 billion enterprise value (0.7x revenue), Gannett is undervalued. Tesla is a great product and company, but at $637 billion (20x revenue), it is overvalued (send in the clowns/trolls). Disclosure: I am a shareholder in Gannett and consistently wrong re Tesla.

Anyway, the office real estate in the U.S. alone is a $2.5 trillion asset class, and it is going to leak the GDP of Switzerland to residential over the next decade. However, it’s not as easy as going short all office firms and long all residential.

The fire that will rage within the office sector will raise seeds of dormancy — and create unexpected winners. One pyrophile plant that emerges from the fire may be WeWork. I’m especially proud of that last sentence.

Why We (might) Work

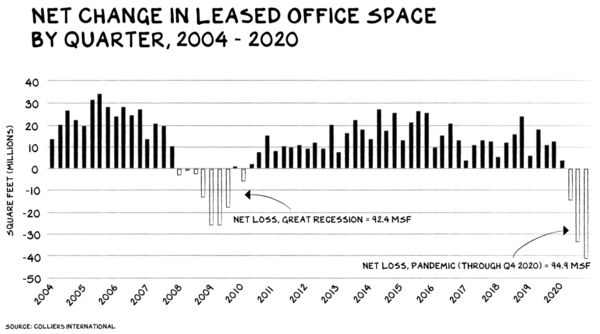

The wholesale abandonment of office space has been among the most striking fallouts of the pandemic, and it will have profound effects on the way we live and work, long after the virus has been tamed.

In New York, new office space is coming on the market 59 percent leased, down from 74 percent pre-Covid.

San Francisco went from its lowest-ever office vacancy rate to its highest in the same year, and office rents are set to decline by 15 percent. The worst may be yet to come.Analysts predict that commercial vacancy rates will rise from 17.1 percent in 2020 to 19.4 percent in 2021, besting the previous high of 17.6 percent in 2010.

And, as $430 billion in commercial and multifamily real estate debt matures in 2021, lenders will be forced to reconcile the effect of the pandemic on their investments.

These changes will endure.

Twitter, Facebook, and Slack have all announced the move to a predominantly remote workforce. Pinterest recently paid $90 million to terminate its HQ lease in San Francisco. REI sold its new headquarters before even moving in, and CVS plans to cut 30 percent of its office space.

At my New York-based education startup, Section4, we asked employees if they wanted to come back to work after the pandemic; overwhelmingly, they wanted to stay home. We paid $1 million to terminate our SoHo office lease.

After decades of promise, the telecommuting revolution is here.

Back in 2017, I predicted WeWork, then worth $16 billion, would lose 75 percent of its value and become the “poster child of unicorn mania.

”Two and a half years later, that prediction was wrong, very wrong — WeWork was preparing to go public on the heels of a $1 billion investment from Softbank that valued the company at $47 billion.

But it just didn’t pencil out.

After deploying my unique domain expertise (math) I concluded: “Any equity analyst who endorses this stock above a $10 billion valuation is lying, stupid, or both.”

The ensuing meltdown was cinematic — literally. Tonight, WeWork gets its closeup, in a documentary on Hulu, The Making and Breaking of a $47 Billion Unicorn.

I’m in it. I have not seen it, but it is a w e s o m e.

Photo credit: Charles Koh on Unsplash