This is Going to Hurt

Green people are out of touch with reality. When the wheel was invented in the Stone Age, they’d have kept dragging things around.

By Capital Thinking • Issue #1055 • View online

Everyone watches oil and they feel the pain at the pump. There is not really a substitute for gasoline. If your car doesn’t have it, it doesn’t go.

Commodity Prices On A Tear

Plant Based Meat Isn’t Going To Be Cheap

Jeffrey Carter | Points and Figures:

Electric cars are expensive and even if we all could run out and buy a Tesla, you cannot get delivery until at least November. That is if they can source computer chips.

I just filled up my tank with diesel here in Nevada and paid $4.86/gallon. I filled it up because I think prices are going higher. That’s inflation and people’s sentiment often drives inflation until underlying data changes.

Buttigieg also has no concept of regular jobs in America.

What if you are a contractor with a pickup truck? What if you get fill-in income driving for Uber, Lyft or deliver food for DoorDash or GrubHub?

What if you are a salesperson that needs a minivan to haul samples?

What if you are a house cleaner that needs a larger car or van to haul supplies and material so you can clean someone’s house? Are we all supposed to get BMW i3s, Chevy Volts, and Nissan Leafs?

Buttigieg is not a serious person and is in over his head. He needs to go back to work at McKinsey.

Pro tip: If you want to be long commodities without actually buying commodities, buy an exchange stock that deals in commodities ($ICE, $CME).

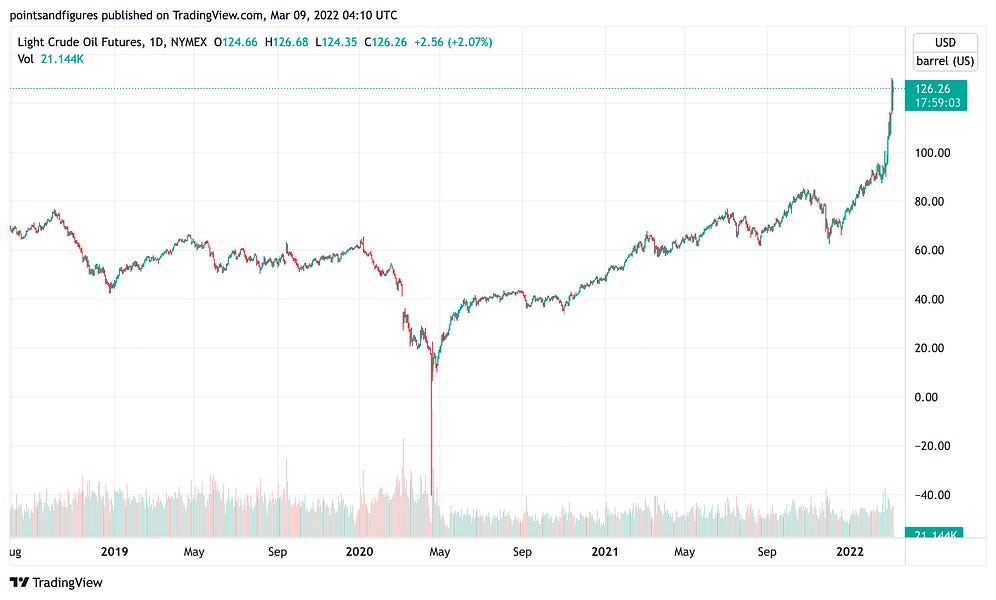

To show you how extreme the move has been in oil here is a chart. It will trade over $150 is my guess. Yes, that is -$40/bbl in late April of 2020.

We have a $166/bbl move so far on our hands.

Here are nickel futures. Russia supplies 12% of the world’s supply. Gee, I wonder why it has a spikey thing on the end?

The main market for Nickel futures trades at the London Metal Exchange. Don’t try to trade them, because they suspended trading.

A Chinese company had a huge short and had to get out. That added a lot of pressure to a market that was already on its way to the moon.

They are still sorting things out as I write this.

For what it is worth, nickel is an essential element in the battery of an electronic vehicle. The other is lithium. Most of that is mined in China although they found a huge deposit in Nevada.

Of course, the Green movement wants the lithium in Nevada to stay in the ground yet they agree with Buttigieg that we all should be buying electric cars.

Green people are out of touch with reality. When the wheel was invented in the Stone Age, they’d have kept dragging things around.

Nickel’s rally, and the reliance on Russia for supply is going to make electronic cars a lot more expensive.

Stainless steel just got a lot more expensive too. How many things does stainless steel go into?

As an old dinosaur commodity trader, I checked out some of the hard-core ag markets to see what they have been doing. It will be no surprise to astute readers of this blog that the prices across the board are higher than they used to be.

Principally, you can blame the level of government spending for that increase. Inflation happens when there are too many dollars chasing too few goods.

The Fed printed dollars, and the Federal government helicoptered them into the pockets of Americans. That guaranteed inflation. Biden’s Build Back Better would increase the rate of inflation, not decrease it.

Two quick ways to decrease inflation are to increase interest rates and really drop the level of government spending. The second will work better than the first.

When you see moves like this in one market, you start to think about margin calls.

Since futures are traded on margin, big moves force exchanges to increase the amount of money they want from traders to hold positions. That happens in rallies as well as breaks.

I can recall being short hogs and watching the stock market meltdown in 2008. Because of the margin calls in stock futures, it carried over to agriculture futures.

It didn’t matter what the underlying supply/demand fundamentals were, every market was going south because people were selling to raise cash for margin.

Here is wheat. Wheat is the main product of Ukraine. I know that Cargill, ADM, and the other big grain companies have huge operations there but I haven’t heard a peep from them.

Being typically corporate, even after their ship got hit with a Russian missile, Cargill didn’t rock the boat (pun intended). Easier to close a McDonald’s than it is a farm operation.

I hear people say “markets are broken” or words to that effect when strange stuff happens.

It’s just that they don’t understand it, can’t figure it out, or had things go against them when prior to the move all their internal logic told them something different.