Tackling TurboTax

All things considered, I think TurboTax is a fantastic business, and will be tough to compete with head on. It’s more likely that the following pieces come together to obviate TurboTax.

Capital Thinking - Issue #868 - View Online

“What if we could give customers a button. They’d press it at the end of the year and it would automagically file their taxes for them.”

Killing Turbotax

Ayokunle | https://twitter.com/ay_o:

At the time I thought the idea was appealing, but didn’t think much more about it. Today, I think this is the way TurboTax gets dismantled.

It’s taking consumer finance companies with massive distribution, combining them with a tax preparation API and real-time visibility into users tax position.

Tackling TurboTax head on is probably a waste of money. Tackling TurboTax asymmetrically has a real shot.

TurboTax is functionally a monopoly

From the outside looking in, TurboTax has a near impregnable moat. In taxes, there’s no clear second player with near the level of distribution, automation, community, trustworthiness, brand recognition and regulatory capture that they have.

They’re incredible at playing regulatory defense by constantly and subtly opposing any government efforts to simplify taxes[1], which simultaneously makes their product more valuable and raises the bar for new entrants. Even the Justice Department recognizes TurboTax as a functional monopoly, and forced Intuit to sell CreditKarma Tax in order to complete the acquisition.[2]

They’re also strong at sniping competition early, before it becomes a serious threat. GoodApril is an example; the company went through TechStars in 2013 and was focused on tax planning, initially for gig economy workers. Intuit acquired them before demo day, pre-empting their Series A.[3]

More recently, from the outside looking in, you’d think they missed CreditKarma Tax by acquiring Credit Karma and selling the tax business to Cash App. I think more likely, CK gained scale before threatening Intuit by launching the tax product.

The acquisition was at least valuable for a) securing CK’s distribution for TurboTax’s use and b) reducing the likelihood that a good competitor would emerge. You might bet that Cash App successfully executes on the transaction, but it’s at least not a guarantee, from Intuit’s perspective.

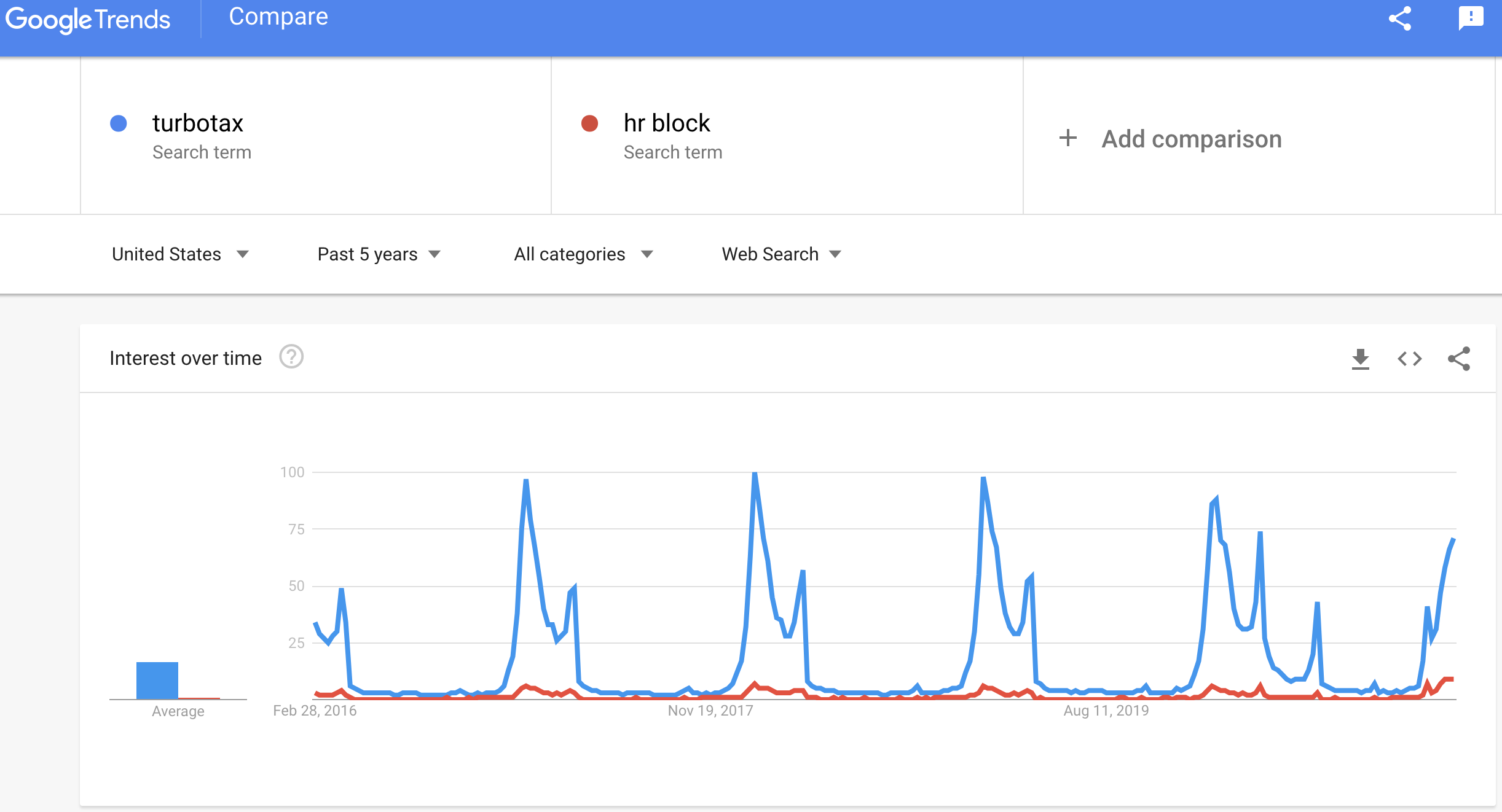

TurboTax also owns the namespace for consumer taxes. Every year between January and April they become the top finance app and a top 10 app in the US Appstore.

It’s possible someone builds a better direct to consumer product focused on tax prep, but I’m skeptical.

All things considered, I think TurboTax is a fantastic business, and will be tough to compete with head on. It’s more likely that the following pieces come together to obviate TurboTax.

Consumer finance distribution + tax prep API + differentiated tax planning (eg real-time tax computation)

The challenge

Unseating TurboTax has been hard historically for a few reasons.

Superb distribution

As a startup, you have a 3.5 month window every year to acquire tax customers. During tax season, TurboTax already dominates the organic acquisition, Appstore rankings and paid acquisition channels.

They’ve been doing it for years, they’re probably quite efficient, and you’re not going to outspend (or smartly out acquire) Turbotax from New Years day to tax day. [4]

Perception & Quality

Doing taxes well for mainstream consumers is complicated, and the consequences of getting them wrong are both bewildering and material. Every year the tax code gets more complex.

This benefits the player who already has internally encoded the complexity, and for whom additional complexity is incremental rather than absolute (starting from 0).

Simply put, you have one shot to build customer trust, and if you get it wrong you really screw up the customer’s life. Why would any consumer take that risk?

TurboTax has been doing your taxes for years, already has your previous filings, and will use them to prefill tons of fields for you. All the while, you’ve probably never been audited. It just works.

It’s time to build (tax prep software)

To defeat TurboTax, a lot of the ingredients exist already. They’re just in the process of being assembled.

Consumer Finance Distribution

To defeat Turbotax, you need consumer distribution that’s as good or better than what TurboTax has. Without this, they’ll outspend you on customer acquisition every tax season, long before you can make a dent.

It helps to already have established consumer trust with an adjacent offering, because if the only benefit of your product is tax preparation, you’ll be forced to acquire customers during tax season and compete head on, and you’ll be outspent.

Today, multiple consumer finance products already have the distribution necessary to compete. These include products like Cash App, Chime, Venmo, Robinhood and others, which have wide ranging customer trust and customer bases in the tens of millions each.

Crucially, these products acquire customers upstream of tax season - they provide financial services to consumers all year around. They also already have a partial picture into a customer’s financial life, and they’re already thinking about customers’ tax needs. Cash App has taken a first party approach (by buying Credit Karma Tax).

Robinhood has taken a lead gen approach (by partnering with TurboTax). No one’s built on a tax API (because none currently exist). [5] For TurboTax this will be death by a thousand cuts - it will be years before a single player files more taxes than TurboTax. But the top 5 neobanks can drain enough volume to have a material impact.

Differentiated Tax Planning: Real time tax position

Turbotax is insanely focused on consumer tax needs during filing season. To date, this has been sufficient to win. Over the last 18 months, however, “new” things are possible around taxes that weren’t before.

Today, high quality income and tax withholding data is available via API. With this data, you can compute your tax position in real time at any point in the year, which has two core financial benefits; a) you can know your tax liability at any point in the year with reasonable precision, and b) with that knowledge, you can optimize it.

For instance, you could build a continuous W2 with Pinwheel’s paystubs endpoint.

This financial benefit wasn’t possible before the last couple of years, and it’s outside of TurboTax’s wheelhouse, because TurboTax optimizes and monetizes the tax transaction at year end, and essentially re-acquires taxpayers each season. Outside of tax season, I basically don’t log into TurboTax.

Photo by Kelly Sikkema on Unsplash