Swimming toward yield

The thing is, money has expectations.

Capital Thinking • Issue #1083 • View online

I know there is not just one simple, overarching explanation for all the weirdness in the world, but, for me, when I see a bunch of scooters strewn about a sidewalk, the first thing that goes through my head is ZIRP.

ZIRP explains the world

For the uninitiated, ZIRP stands for zero-interest-rate policy. I will assume most Margins’ readers are peripherally familiar with the term, but to clarify, it’s when a nation’s central bank pushes nominal interest rates to 0% using monetary policy.

There are a million complexities to how it’s executed, and nowadays rates can even go negative (NIRP), but for this piece, I’ll just refer to all exceptionally low-interest-rate policies as ZIRP.

My co-host Can recently introduced me to the physics concept of a ‘theory of everything’: a hypothetical single, all-encompassing, coherent theoretical framework of physics that fully explains and links together all physical aspects of the universe.

That’s how I feel about ZIRP and all things business today. To understand why let’s first talk about money.

THE FLOW

Maybe it’s because I was an economics major or a currency trader, but I think of money as a living thing.

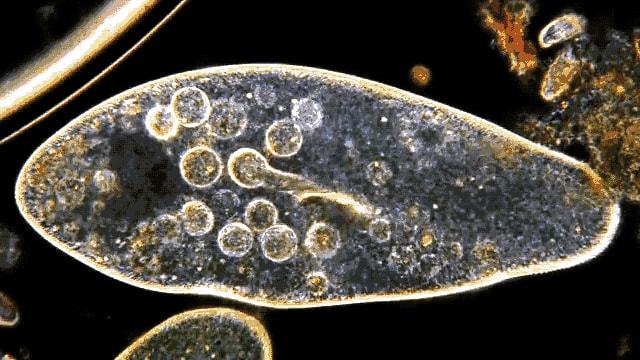

Not as a sentient, conscious being, but more like one of those prehistoric, single-celled organisms.

Or maybe sperm swimming towards an egg. Just millions and trillions of tiny little living things driven solely on biology towards some unforeseen source of nourishment; some instinctual goal.

Money is always swimming towards yield.

Millions of investment professionals are taking tens of millions of actions, every day, to help drive capital to its sustenance. The entire global capitalist economy rests on this constant flow.

So what happens when you lower interest rates (especially to zero)?

All those millions of little dollar-organisms have to change course. They need to find a new source of life.

THE RISK CURVE

All investment decisions are, in theory, an evaluation of risk versus reward.

The US Treasury 3 Month Bill is often thought of as a “risk-free rate of return”, or the yield you deserve for effectively assuming zero risk. It’s called “zero risk” because we’re assuming the U.S. Government will not default on their debt in the next 3 months.

For reference, this currently gives you 0.71% (and was 1.25% when I started writing this on Monday 🥶).

That’s your starting point. The more risk you take, the more yield you should get.

If we’re just looking at U.S. treasuries, the longer the maturity, the more yield you should get because there’s more time that the U.S. government could default (note: at the moment, this is not the case because of an inverted yield curve, which is a whole other thing).

Then you start looking at U.S. investment-grade corporate debt, like a bond issued by Apple. It’s a tiny bit riskier, so you should get a tiny bit more return. Then you move out to high-yield corporate debt which is a bit riskier.

You keep moving out the curve, getting to hedge funds, private equity, venture capital, and real estate, and on and on. For each additional increment of risk you take, you get a bit more yield.

The image below from KKR, is the closest thing that represents what I’m talking about. The whole 80-page report is very good on this topic if you’re interested.

CHASING YIELD

The thing is, money has expectations.

At an individual level, most of us have become accustomed to bank savings accounts effectively returning zero.

That wasn’t enough for us though. Our money felt antsy, so it found index funds and other passive funds, to once again, find a bit of yield.

They are certainly riskier than a bank savings account (where your only risk is the bank going under), but hey, no one has ever really lost in a Wealthfront account.

Money swims towards yield.