Strong Opinions, Weakly Held

Think of your beliefs like clothing, not tattoos.You want to be able to easily change and adapt them for you, but not have them become a permanent part of who you are. This will be true for you as an investor and decision maker throughout your life.

Capital Thinking • Issue #596 • View online

People don’t like thinking, but they love certainty. Thinking takes mental energy and time, so why do it?

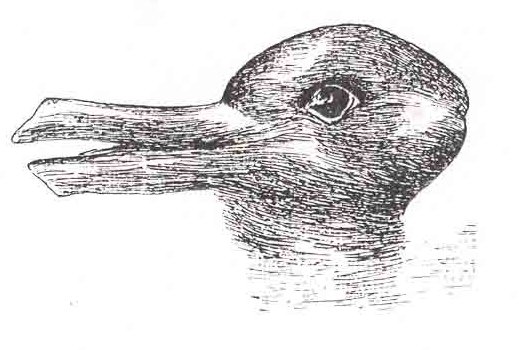

You See What You Want To See

Nick Maggiulli | Of Dollars and Data:

Dan Kahan, a professor at Yale Law School, was interested in understanding how an individual’s beliefs affected their recollection of an event.

In order to test this he had two groups of students watch a video of a protest. One group was told that the protest was against legalized abortion and the other group was told that it was against the ban on openly gay/lesbian soldiers from serving in the military.

After collecting information about the students’ political beliefs, Kahan found that the students’ reactions to the video were highly correlated with their pre-existing views.

For example, those participants that were against legalized abortion, “saw” the protest as a peaceful expression of dissent, while those that were for legalized abortion “saw” the protest as an act of physical intimidation.

From the experiment:

Subjects of opposing cultural outlooks who were assigned to the same experimental condition (and thus had the same belief about the nature of the protest) disagreed sharply on key “facts”—including whether the protestors obstructed and threatened pedestrians.

Here’s the rub though—all the students (across both experimental groups) watched the exact same video.

Kahan had cleverly edited the protest video to make it topic neutral. No one saw anti-abortion signs or anything related to “don’t ask don’t tell”, so they were not trigged or persuaded by the content in the video, only by the content in their minds.

We see what we want to see.

This concept, known as confirmation bias, demonstrates why we tend to ignore or reject information that goes against our most deeply held beliefs.

I know that you have probably heard of this concept before, but with the rise of our digital gatekeepers (Facebook, Google, Twitter, etc.) it is getting easier and easier for you and I to experience confirmation bias.

This is true because these systems were optimized for engagement and not truth nor intellectual diversity.

Your actions curate your feed and, before you know it, you only see opinions you agree with.

I know I do this too, yet I still cannot help myself.

Think of your beliefs like clothing, not tattoos.

You want to be able to easily change and adapt them for you, but not have them become a permanent part of who you are.

This will be true for you as an investor and decision maker throughout your life.

*Featured post photo by Steve Johnson on Unsplash

Additional Reference: