Risk Given Reward

I think that people really don’t understand risk, how to quantify it, or how to manage it. Sometimes you have to accept it and you can’t do a thing about it.

Capital Thinking · Issue #988 · View online

If I told you that I would fund your trading account if you jumped off a bridge and landed in a river, would you do it?

I have a friend that actually did this by the way.

It’s Not About Assuming Volatility, It’s About Assuming Risk

Jeffrey Carter | Points and Figures:

You can’t see the bottom. You don’t know exactly how deep it is. You might not know if the water is clean or not. But, if you wanted to trade, would you take the risk? How about going over Niagara Falls?

One is clearly more risky than the other.

I was thinking about this when I read this tweet.

First, what is volatility? I think this tweet gets it wrong.

Volatility is the measure of the spread underneath some probability distribution. Volatility is really “variance”. Sigma squared in statistical terms.

Here is a visual representation using normal distributions. Tight distribution, low volatility. Wide distribution, more volatility.

More volatility simply means more risk.

But, just because something is volatile doesn’t mean that you can earn outsize return.

Some assets can earn an outsize return but it’s often hard to know which ones. Investing in some assets can be binary, gain or total loss.

I do find from experience that if you invest in something everyone else thinks is great and also sees means your return will be smaller.

If you want to invest and get outsize return, you will have to invest where the crowd doesn’t see it. Be that bull that faces the herd and doesn’t run with it.

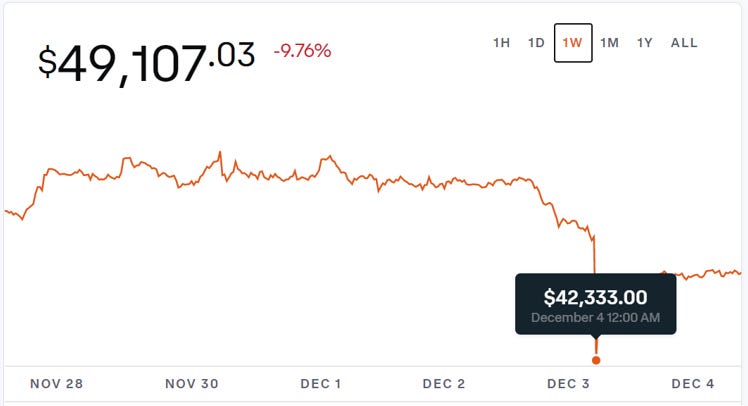

For Bitcoin, you were that person five to ten years ago.

The herd knows about crypto and Bitcoin now. They might not understand it. They might not believe in it. But, they know about it.

Bitcoin returns could still be great, but should be less than they were.

It’s like investing in startups. Who makes the most money?

Data shows that the investments in seed-stage do better. However, they take extreme risks and often fail. Ideas at that stage look stupid. The herd doesn’t see it.

The entrepreneurs are often unproven. Investing later in the cycle can make you money but you are assuming less risk.

I think that people really don’t understand risk, how to quantify it, or how to manage it.

Sometimes you have to accept it and you can’t do a thing about it. That’s what happens to me when I invest in a startup.

I feel confident about my investment because of the background research I did to make it. I feel confident based on other factors and my own experience. But, once the money is wired I have very little determination on what the outcome will be.

Even if I have a great network and can put the entrepreneur in the batter’s box to take a swing, I can’t take the swing. I also can’t really hedge the risk I took.

My only action is binary, take money off the table or not. If you take money off the table in seed-stage investing and you do it too soon, you will wind up not making money over the long haul.

To make money, you need to do the research. You need to do a lot of homework and look at things objectively.

Of course, the more research you do the more able you will be to figure things out quickly and assume more risk. Doing the work creates a virtuous circle for yourself.

Even when you do the work, you might lose.