Risk-Free? Your Mileage May Vary.

It’s expensive to not lose your money, but it may get cheaper…

By Capital Thinking • Issue #902 • View online

The latest “Known Unknowns” from Allison Schrager in which she will explain “what to do with all the wealth we don’t have” and introduce us to Universal Basic Wealth.

“Basic Income” just isn’t going to get the job done.

After all, this is about winning hearts, minds, and elections. And “Universal Basic Wealth” does touch all the bases, doesn’t it?

Safe asset shortage, we hardly knew thee

Allison Schrager | Known Unknowns:

It seems like for the last 15 years or so we kept hearing about the “safe asset shortage” – it was the source of the savings glut. The story went that the world was desperate for “risk-free” assets – or assets that are liquid and provide a certain rate of return.

They were desired by foreign governments looking to manage their currencies and capital flows, banks for regulatory purposes, and, well, anyone looking for low-risk assets.

The safe asset shortage brought down interest rates, made investors open to assets that weren’t so safe – but you could squint and pretend they were (think Greek debt or mortgage-backed securities). It also is why the US government could spend like crazy, and the bond market did nothing but shrug.

All of this caused all sorts of problems.

It seems like you don’t hear much anymore about the shortage. Foreigners are not buying US debt like they used to, and that’s a pretty big deal we don’t spend much time thinking about.

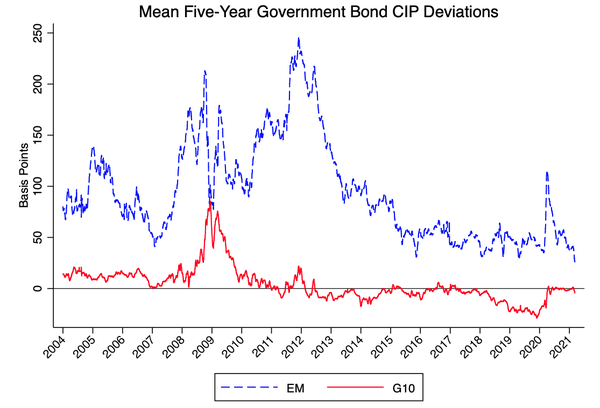

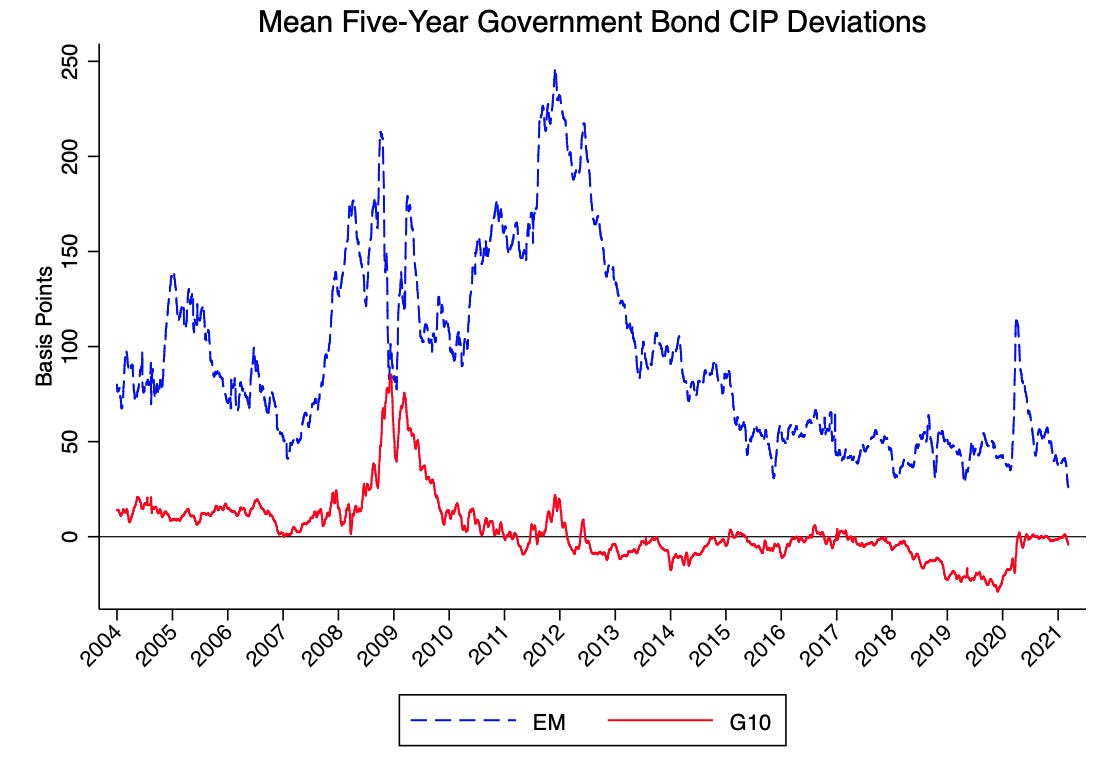

Stanford finance professor Hanno Lustig sent me this nice picture from Wenxin Du that shows covered interest parity deviations for US Treasuries. It suggests that the premium foreign investors are willing to pay for US Treasuries is falling (especially for long-term debt) and may even be negative now.

The safe asset shortage may be over. So why are still rates so low?

The Fed is still buying lots of debt and it provides a big safe asset in the form of reserves it pays interest on. But this raises the risk of a safe-asset glut, if, say, the Fed starts selling instead of buying bonds – if, say, it decides to do something about inflation.

Speaking of gluts, the Fed is planning on taking more repos, hoping this will help the bond market work better in the future if things do get gnarly, though it may just be stealth tightening.

But we should be concerned (not panicked, but concerned) because a glut could mean rates go up – and not in a gradual nice way.

Both a glut and a shortage cause trouble. Markets are happier when they are in equilibrium. And, with the amount of debt we are carrying, I think I’d take a shortage over a glut.

Universal Basic Wealth

The strange new policy idea coming from Silicon Valley is universal basic wealth. It’s like universal basic income, expect you get a pile of money once, twice, or several times to build your bank balance.

Eric Schmidt and Evan Spiegel think the state of California should take its budget surplus and give everyone a cash payment, which is automatically invested in – you won’t believe this one – start-ups in Silicon Valley that they also invest in.

Photo credit: Jim Beaudoin on Unsplash