Rich or King? The Founder's Dilemma.

“There’s a line you cross where your savings alone will fund a reasonably lavish lifestyle. At the risk of sounding like George Bush, this is a Freedom Line — freedom from restrictions about what you can do with your life, family, and career." - Jason Cohen

Capital Thinking • Issue #100 • View online

“See, it’s good to be “King,” but what do you do when you’re at Trudy’s “North Star” Tex-Mex Restaurant tucking into a chile relleno (with salsa verde, black beans, and the ground beef filling), and the guy across the table looks you in the eye and offers you enough money that you never have to work again?”

-Jason Cohen

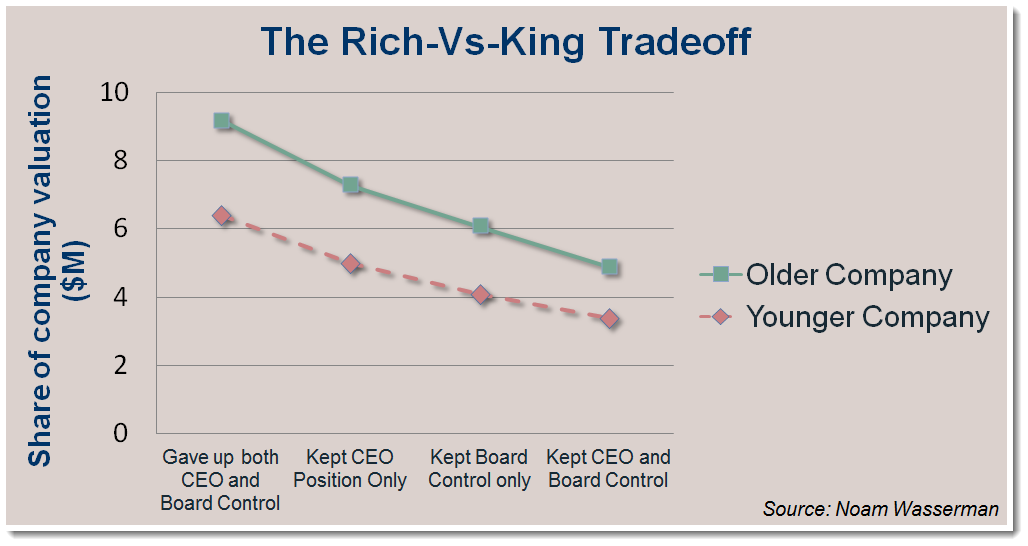

Back about a decade or so ago, Noam Wasserman wrote an influential paper titled “The Founder’s Dilemma”.

In it, he described the path that most startup founders chose to take: They elected to cash in their chips and sell out. Fewer than 25 percent of those original company leaders were able to stay on the job for very long.

In fact, Wasserman found that four out of five CEO’s were forced to leave or were “pushed” out of office. And when that happens, the void left behind can cause more than a little bit of turmoil.

To counter this, he makes the suggestion that founders be honest with themselves as well as with their investors, bankers, board members, and employees as to their motives.

In other words, as a business founder or CEO, what’s in it for you?

Why did you begin this journey? What moves your needle? Is your mission to “change the world”? To build a better life for your employees and family? Or, are you just in it for the bucks?

This isn't about wishes. It's about choices.

Wasserman makes his point like this:

Jason Cohen, the author of the story in the introduction to this piece, Founder/CEO of Smart Bear and now WP Engine, frames it a bit differently.

Let’s hear from Jason again:

“There’s a line you cross where your savings alone will fund a reasonably lavish lifestyle. At the risk of sounding like George Bush, this is a Freedom Line — freedom from restrictions about what you can do with your life, family, and career.

My observations:A movement from left of the line to right of the line changes your life fundamentally, giving you the freedom to do whatever makes you happy, forever.

If you’re crossing from left to right, it doesn’t matter how far to the right you go. (Sure, $100m is a different lifestyle than $10m, but it’s not as critical to lifestyle or happiness as just crossing the line.)

#1 is what was offered to me at Trudy’s Tex-Mex. #2 means it almost didn’t matter what the offer was, so long as it was big enough.”

All in? Or, ...

“… this isn’t a question of math or economics or intelligence; it’s a measure of your attitude towards risk.” - Jason Cohen

Indeed it is.

This is a decision that won’t come easily to many, but here’s the deal: from the standpoint of an investor, whether or not you are tempted to fold is pretty important.

If you really think you’re the only one who can run your company, then that might temper my enthusiasm for lending you money.

No offense. I just may need to know if you’re willing to throw away a chance at a great payday - and the best prospect for me getting a return on my investment.

Sources:

*Featured post photo by Ginna Shernoville on Unsplash

*First published June 29, 2018 on Capital Thinking