One For the History Books

Stock markets crashed and bond yields collapsed as coronavirus ravaged the world: whatever happens next, 2020 will be one for the history books.

Capital Thinking • Issue #601 • View online

The middle of February 2020, and the global stock market is riding high.

There are concerns – the unpredictable US president, Britain’s disentanglement from the EU, and how quickly China can recover from a new virus that has turned a key city into something from a dystopian novel – but also optimism.

The US/China trade spat is easing. US election years tend to be good for markets. There’s also the Olympics to look forward to.

Fast-forward fourteen weeks and… wow.

14 weeks and 12 numbers that have changed the investing history books forever

We’ve been living through a real-life disaster movie. The build-up was tense and then the action exploded at an unimaginable pace.

Heroes and villains filled our TV screens, augmented by scenes of human misery and suffering. Millions sickened – hundreds of thousands died.

Billions ‘sheltered in place’ as the US lingo puts it, many terrified of leaving their homes.

We’re only just beginning to realize the cost in terms of jobs, economic dislocation, and the ginormous IOUs written by governments worldwide.

Investors have had a front row seat.

The stock market’s reaction may seem exaggerated – like an excitable child in the row behind us, screaming and gasping as events unfold. But it’s also uncannily predictive.

By late February it saw things taking a turn for the dramatic, and began to swoon. Portfolios reeled.

For the rest of our lifetimes we’ll see data points from 2020 popping up in any backwards-look at the records.

The textbooks blogs won’t need to be rewritten – event-driven crashes are nothing new – but such was this one’s ferocity that the data will need to be revised.

Here are some numbers for the ages.

1. The S&P 500 fell 30% in 22 days

US markets saw the 30% fastest decline ever.

Other markets plunged even more steeply, but the US S&P 500 is the big beast of the jungle. Its companies make up more than half of the global equity portfolio.

2. The spread on the riskiest debt jumped by 9.8%

A frantic dash for cash and into the safe havens of government bonds saw riskier bonds dumped overboard like orders for Tokyo 2020 t-shirts.

Widening credit spreads are normal in risk-off environments, but again the speed here was dramatic.

According to Morningstar, spreads for BBB, high-yield, and CCC and lower-rated credits jumped 3.57%, 7.30%, and 9.78%, respectively, during the peak-to-trough period. This was the largest widening within a month-long period since the 2008 financial crisis.

3. The Vanguard Total Bond Market ETF traded at a discount of 6.2% to net assets

The money markets looked in danger of breaking down. On 12 March the Vanguard Total Bond Market ETF traded at an unprecedented 6.2% discount to its net asset value (NAV).

Oversimplifying hugely, this implied investors could buy the ETF, sell its underlying holdings, and make an instant profit. But of course they couldn’t, because liquidity was evaporating, and also the apparent discounts on many bond ETFs anticipated declines in market prices in advance of them being discovered with real-life trades.

On Sunday 15 March the US Federal Reserve rode to the rescue and the disruption was contained.

4. The UK government announced a £350 billion economic defence package

We’ve never seen anything like this government intervention outside of wartime – and not even then so baldly declared.

On 17 March the newly-installed UK chancellor Rishi Sunak told the country he was ready to deploy £330bn in loans and £20bn in other aid.

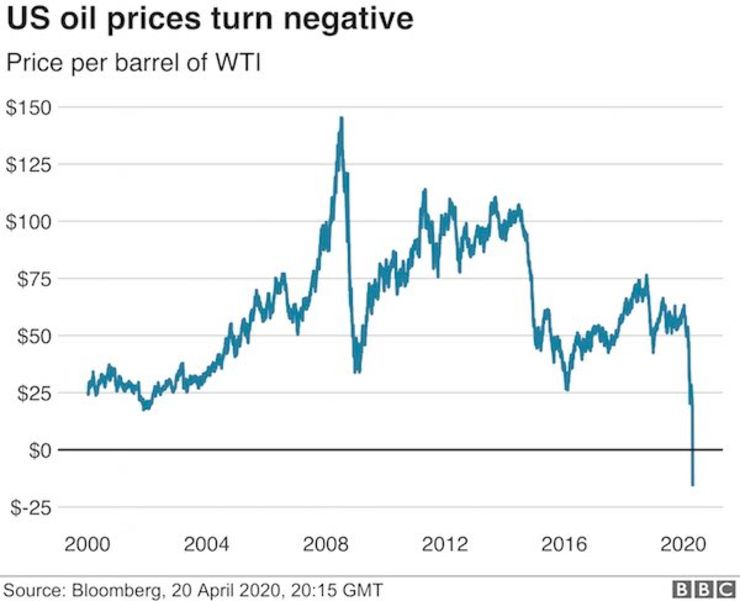

5. US oil prices went below $0

Here’s something else you don’t see every day. Or indeed, ever.

On 20 April the price of oil in the US – as indicated by futures contracts – turned negative. In theory this meant an oil producer would pay you to take oil off their hands.

Oil demand had collapsed with the global lockdown, and storage capacity looked close to full.

“This is off-the-charts wacky,” Stewart Glickman, an energy equity analyst at CFRA Research, told the BBC. “The demand shock was so massive that it’s overwhelmed anything that people could have expected.”

6. Some 20.5 million US workers lost their jobs in April

This cover from The New York Times is a legendary effort that will define the period.

Breathtaking and defying almost everyone’s worst-case scenarios back in late February – whatever they now say they believed back then.

*Featured post photo by Juan Sisinni on Unsplash