Moving the Goal Posts

You don’t have to be reminded of this anymore, because WallStreetBets has forced it out into the open. The system is structured so that Joe Public loses, and the Establishment always wins, even if they have to change the rules or endlessly move the goalposts to do it.

Capital Thinking · Issue #772 · View online

A couple weeks ago one of my brother-in-laws asked me about investing in Bitcoin (he knows I’m gearing up a newsletter specifically about crypto equities) and it made me wonder if we were near the top of this cycle.

Sure enough, BTC has come off a good 25% off the peak, Ethereum is still holding up near all-time-highs. But it was that everyman-talking-Bitcoin dynamic that is almost a trope now.

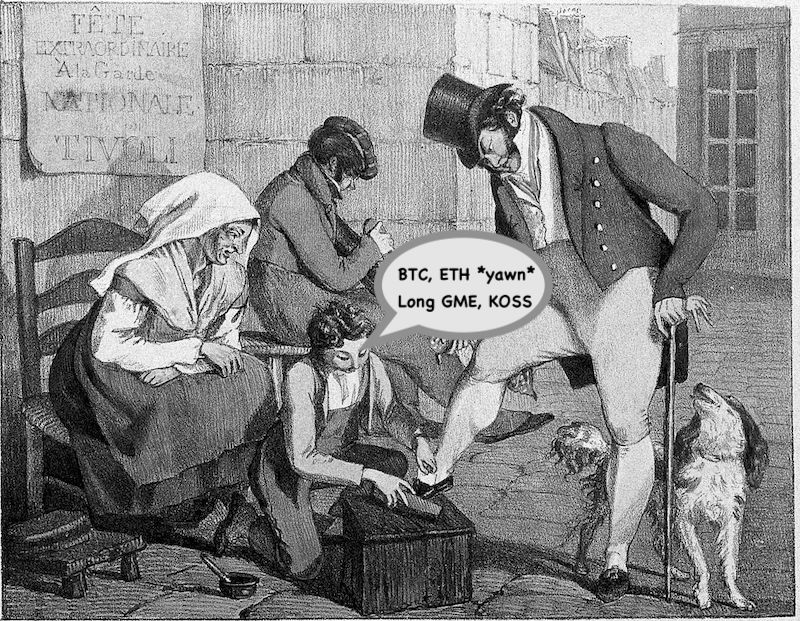

Starting with the possibly apocryphal story of Joseph Kennedy top-ticking the stock market in 1929 upon receiving hot tips from the shoe-shine boy ,the idea that when “normal people are getting rich, something has to be off” was almost conventional wisdom.

Until now.

WallStreetBets Proves the System is Rigged

Now it’s not conventional wisdom, it’s Establishment Canon.

I trust you already know the story of /r/WallStreetBets because even more everyday people are talking to me about Gamestop over the last 72 hours than Bitcoin (cryptos skyrocketing a mere 50% or 100% is quaint now. The slow lane).Gamestop (et al) is where the action is now. At least until this morning.

The epic short squeezes had some hedge funds being carried out because their naked shorts have blown up. Reddit clamped down on WallStreetBets, briefly making the subreddit private and then re-opening it.

I actually expect Reddit to suspend them, any second now.

WallStreetBet’s Discord was shut down (for “hate speech” – get used to hearing that one from now on) and as of this morning, Robinhood has suspended new long positions in Gamestop, AMC and a few other garbage stocks that hedge funds were shorting the hell out of.

As many are quick to comment…

The hypocrisy at work this week is manyfold

Barstool Dave Portnoy is roasting RobinHood on Twitter while another notedFunny to see @RobinhoodApp promoting Finance Democracy whilst blocking people who are exactly exercising finance democracy from buying $GME, $AMC and $NOK. pic.twitter.com/fjkDcupZxT— Derek (@derekhkwok) January 28, 2021

And in his letter this morning Tom Woods called it “The Gamestop Rebellion”, observing:If the average American suffers a loss, that’s a darn shame. If big players suffer a loss, shut everything down!

Mike Swanson at WallStreetWindow assembled a truly dizzying set of charts of the issues affected and noted the juxtaposition:These are all epic short squeezes and the traders on the internet, many of whom are apparently Robinhood traders, are celebrating and going wild, but on CNBC and much of the mainstream media there is outrage and a call for regulation as the short squeezes are crushing big money hedge funds short these stocks.

This is all indicative of a creeping two-tier system I’ve been writing about for years, and talk about on my mailing list.

Thanks to The Great Reset this now looks to be veritably enshrined in law under this asymmetrical governance structure euphemistically called The New Normal.

The New Normal means the Fed will print up money to buy the bonds of worlds largest companies, career politicians (or their spouses) will make millions buying up call options of those very same companies.

The New Normal means that big box stores get to stay open while small and independent businesses are declared non-essential and ordered closed, indefinitely.

And then when the people on the wrong end of this stick get paid a pittance that amounts to asswipe money, and they push it into the stock market and end up making a killing, what happens?

The ref throws a penalty flag from the sidelines and the rules get changed.

Here’s Jim Cramer talking with Pacific Capital’s Herb Greenberg who vehemently calls what is happening “manipulation” and “illegal”, going so far to trot out the “this could be the work of foreign powers” card. Uh huh.

Cramer, for his part is being a bit more stoic about it, perhaps because he knows he’s on record and on film describing how he routinely manipulated stocks back in his hedge fund days:“You know a lot of times when I was short at my hedge fund and I was positioned short meaning I needed it to open up, I would create a level of activity beforehand that could drive the futures. It doesn’t take much money.

Similarly if I were long and I would want to make things a little bit rosy I would go in and take a bunch of stocks and make sure that they are higher, you know maybe commit five million in capital do it.

And I could affect it. What you’re seeing now is maybe it probably is bigger market now, maybe any ten million capital and knock the stuff down but it’s a fun game and it’s a lucrative game."

No better example exists of The Great Bifurcation between Wall Street and Main Street than CNBC and Jim Cramer:When Main Street companies lay off workers, it’s the way of the world but the stock could be a buy, but when a bunch of bankers and hedge funds blow themselves up because they levered up on bullshit derivatives that unceremoniously imploded, as Cramer’s now legendary meltdown during the GFC illustrates: that’s a crime against humanity.

*Featured post photo credit: Guillaume de Germain on Unsplash