Keeping Us All Guessing

If we’ve learned anything the last few weeks, it is that we don’t get wiser with each generation, we just repeat our mistakes. I wonder if the great moderation was a fluke, a golden era of good monetary policy we can’t sustain because we are too human.

August 31 · Issue #921 · View online

The latest straight talk from Allison Schrager who makes her position perfectly clear:

“Welcome to Known Unknowns, a newsletter that will always be straight with you and then trust you to use that information to make your own choices."

Jackson Hole

The Fed’s Jackson Hole Symposium kicked off on Friday.

Most market watchers are trying to decipher Jay Powell’s cryptic words to figure out when tapering will happen. The answer appears to be soon, but not sure when, when it is time.

He insisted that high inflation is entirely transitory and he’s monitoring inflation expectations (which is how inflation could take off), but didn’t explain what the Fed is doing to keep them anchored.

So much for clear, credible communication from the Fed as best-practice monetary policy.

When I took Mishkin’s money seminar in grad school, I was taught that monetary policy can’t have an impact on the real economy, but it can smooth out rough edges if done properly. Properly is limited in scope and is humble.

You can’t keep the market guessing and trick it into avoiding a downturn. If you try this, people catch on, and you squander your credibility when you need it.

So, the best action is to pursue simple clear, achievable goals and honest credible communication – or not speaking in code out of fear the market may drop for a few days.

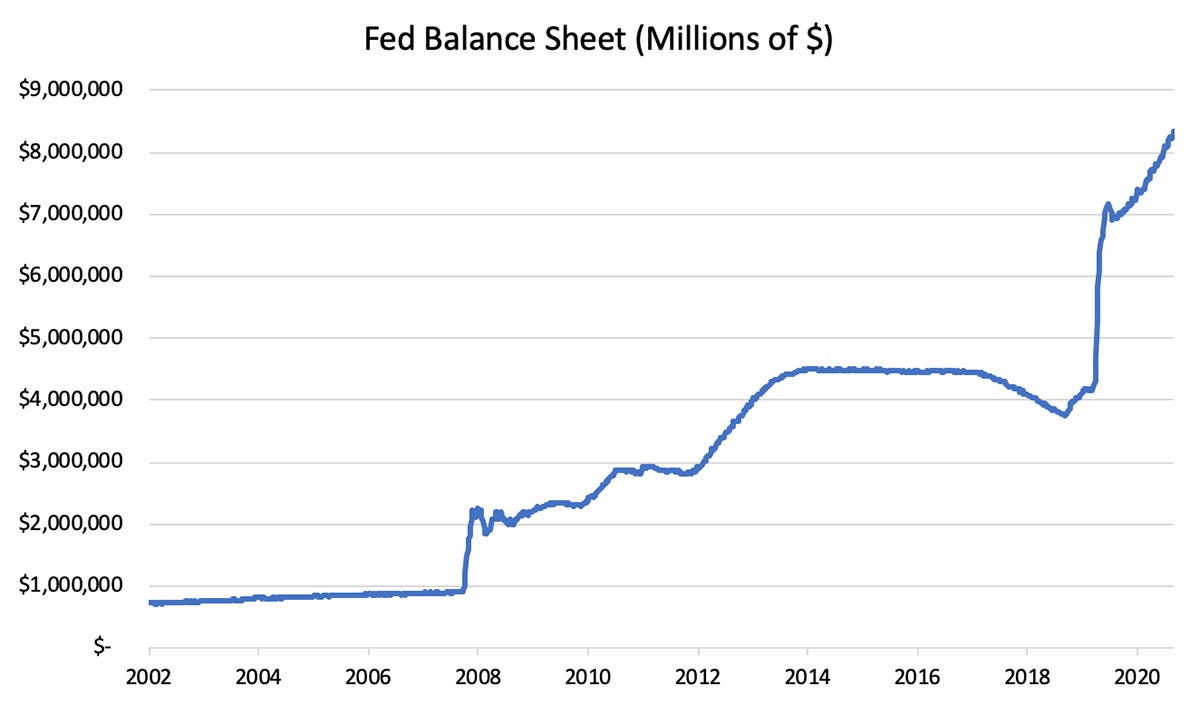

What’s crazy is that we aren’t even taking about tightening. Just slowing the pace of buying private and long-term assets, for what was supposed to be an emergency measure when financial markets have seized up.

Trillions of dollars later, this is the new normal and in nonemergency situations.

Perpetual QE seems to pose more downsides than upsides, as is the belief that these policies can solve all our economic ills – from climate change to economic inequality.

Students of the history of monetary policy know this is dynamically inconsistent and how it turns out – an inept Fed no one trusts and more volatile cycles.

But, if we’ve learned anything the last few weeks, it is that we don’t get wiser with each generation, we just repeat our mistakes. I wonder if the great moderation was a fluke, a golden era of good monetary policy we can’t sustain because we are too human.

Behavioral economics faces a reckoning

Photo credit: Cora Leach on Unsplash