FLASHBACK

The most important thing to remember about the markets is they are constantly surprising — both to the upside and the downside.

Capital Thinking • Issue #1172 • View Online

Think back to 2010.

After you got done signing up for some new app called Instagram and finished 17 shows and movies about vampires, maybe you finished reading The Girl With the Dragon Tattoo trilogy.

Once all that pop culture consumption was done, you would have needed some non-fiction to keep up with the intellectual crowd so you moved on to The Big Short by Michael Lewis.

An Incredible Chart of the Housing Market

Ben Carlson | A Wealth of Common Sense:

Everyone knew the 2008 crisis was a doozy while we experiencing it but reading Lewis’s book made it seem even more ridiculous.

Hearing the vivid stories about subprime bonds, lax lending standards and over-the-top mortgage broker conferences was a stark reminder of just how crazy the real estate boom and bust was.

Now imagine future you travels back in time via Doc Brown’s Delorean from the year 2022 but only wants to talk markets with your former self (just go with it).

The 2010 version of you would likely ask the following:

Surely we had a double-dip recession in 2010 or 2011, right?

And the stock market went nowhere for years because the CAPE ratio was too high?

And the Euro probably collapsed from their debt crisis?

And the housing market is probably still digging out of its hole?

Actually…the only recession we’ve had since then was basically man-made because of the pandemic, the Euro is still hanging in there and the U.S. stock market is sitting on double-digit returns:

Just like no one thought it was possible for the stock market to get cut in half twice in the same decade in the 2000s, I’m not sure anyone was predicting a lengthy bull market in the aftermath of the financial crisis.

But what’s occurred in the housing market might be even more surprising to someone whose knowledge of the markets is capped at 2010 levels.

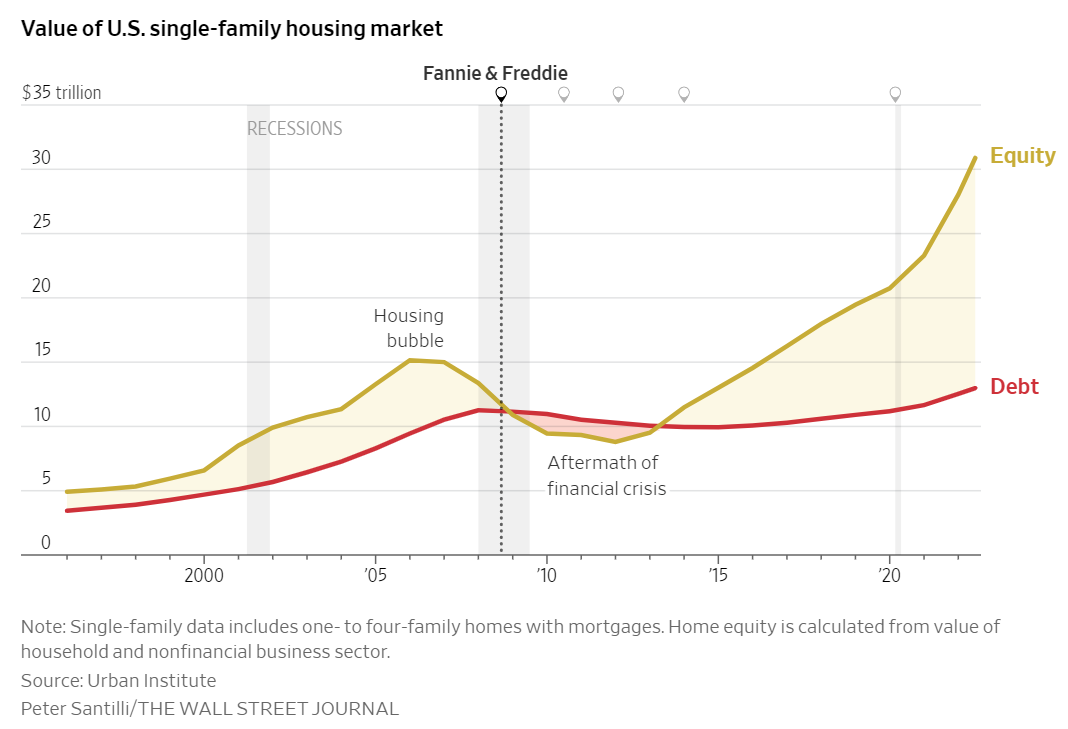

Just look at this chart from the Wall Street Journal on home equity vs. mortgage debt:

It makes the housing bubble look quaint by comparison.