Fear Porn

A part of me hopes that the facts will matter. That society will look at this and say…why we really are foolish to panic and create hysteria over something that kills an absolutely de minimis number of people.

Capital Thinking • Issue #589 • View online

Pray tell how as a leader of a country…any democratic country – you can turn around and tell your citizens. Hey sorry about that.

We panicked and destroyed the economy and racked up debts that we won’t possibly be able to pay back, and we did it based on a flawed model that was never peer reviewed.

You’d be immediately considered a buffoon…and rightly so.

No…instead you’re going to do everything in your power to ensure that citizens are treated like mushrooms.

Kept in the dark and fed isht.

LTCM, The GFC and Covid-19. THIS Connects all Three

Chris MacIntosh | Capitalist Exploits:

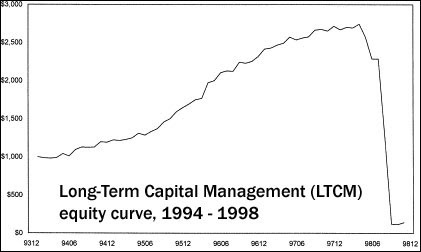

You may not remember it but for finance geeks we either remember, or have heard of the debacle that was the giant bond trading hedge fund Long Term Capital Management that grew from $1.25 billion at launch to over $100 billion in under 3 years!

Admittedly I was still at high school trying to ogle teenage girls cleavage when it all unfolded, and so I was…ahem…”otherwise occupied” but I sure as hell heard about it and subsequently read up on the theatrics upon entering the industry.

The thing with LTCM was that it was run by finance veterans, two Nobel prize winners, PHD’s and professors. It was an all stars team.

They proceeded to knock out 40% a year for about 2 years leading everyone to believe that they were indeed Gods.

The way they made money was by bond arbitrage and mean reversion based on statistical models they’d built.

Come 1998 and the Russian government defaulted on their debt. This is when their model finally met with the real world.

Mark to model rapidly became mark-to-market as the Russian ruble collapsed (something not in their model).

And that was the end of LTCM, who had to be bailed out by the FED providing them with enough time to survive in order to liquidate their positions without endangering the entire financial system.

As it was the Dow lost 19.2% from 7/19/1998 to 8/31/1998 and enjoyed the largest single-day decline of 6.4% on the 31st August 98.

The fascinating story is recounted in Roger Lowenstein’s book, ‘When Genius Failed‘. If you like this sort of stuff I highly recommend it.

One thing even more interesting than cleavage is that when things began to turn awry for LTCM the firm continued to believe in their model…even though the real world was screaming at the top of its lungs “YOU”RE WRONG, GET OUT, GET OUT!”

As we know they didn’t….and completely pha-cd things up.

The Global Financial Crisis example:

Closer to home, at least in terms of time frame was the GFC.

Here we had large money-center banks staffed with rocket scientists in $1,000 suits, who built fancy risk models (VAR), figuring that their models would protect them from themselves.

Which if you think about it is kind of like deciding that yes you are going to become a heroin addict but you’ll include in your diet some greens and a few multivitamins so you’ll be just fine.

A logical contradiction.

You see the idea was that lending money to folks who hadn’t any money of their own would be just fine provided you packaged what were so obviously ishty loans with tranches of other similarly ishty loans, creating DOI (diversification of isht) and this would magically render the entire isht sausage to be of high quality.

Models remember?

Built by rocket scientists.

I’ve worked with some of them in a past life. Brainy AF.

A bit – you know…geeky, zero sense of humour but nice people.

The problem with all of the above is that any model no matter how sophisticated is a patchwork of guesses on how the real world will work.

They’re better than nothing at all but an over reliance on them inevitably ends badly.

They work until – they don’t. Mark to model is the same as mark to market…until it isn’t.

And you know what happened in the GFC which was EXACTLY the same thing that had happened in the LTCM crisis before?

The market began screaming “YOU’RE WRONG, YOU’RE” WRONG, GET OUT GET OUT!” and while those who were listening to the market saw what was so obviously coming, you know what the folks with the models did?

They ignored the market and relied on the models.

Models are useful to be used when we’ve no other options.

But as soon as we have actual live events and certainly data, history indicates that you really need to plug that data in.

That’s real…the models are after all guesswork. Educated guesswork but guesswork nonetheless.

A part of me hopes that the facts will matter.

That society will look at this and say…why we really are foolish to panic and create hysteria over something that kills an absolutely de minimis number of people.

It is a tiny part of me. Ironically not the rational part, rather the hopeful clinging desperate part of me.

It is the part I try to bring back in order to fall asleep at night, because within it lies the hope that facts matter.

But a much much bigger part of me, that which is forged in reading man’s history and watching markets for all of my professional career, worries that we’ve passed the rubicon.

*post photo by Hello I'm Nik 🎞 on Unsplash