Rock me back to the 60's!

History doesn’t repeat but it often rhymes. I don’t know if it was Einstein, Twain, Munger or someone on Instagram who originally said this but it’s certainly something market people say all the time. -Ben Carlson

Capital Thinking · Issue #1023 · View online

Is This the End of the Go-Go Years?

Ben Carlson | A Wealth of Common Sense:

We humans are pattern-seeking creatures so it makes sense that we would continually look to the past to help us explain the present or future.

Assuming we understand exactly what’s going to happen based on what’s already occurred helps put our minds at ease, even if we all know predicting the future is impossible.

I do believe human nature is the one constant when it comes to understanding the markets over time but I also believe humans are unpredictable.

While the markets are always different now than they were in the past for the simple reason that our knowledge of the past compounds over time, you can’t ignore the fact that certain markets do feel eerily similar across time.

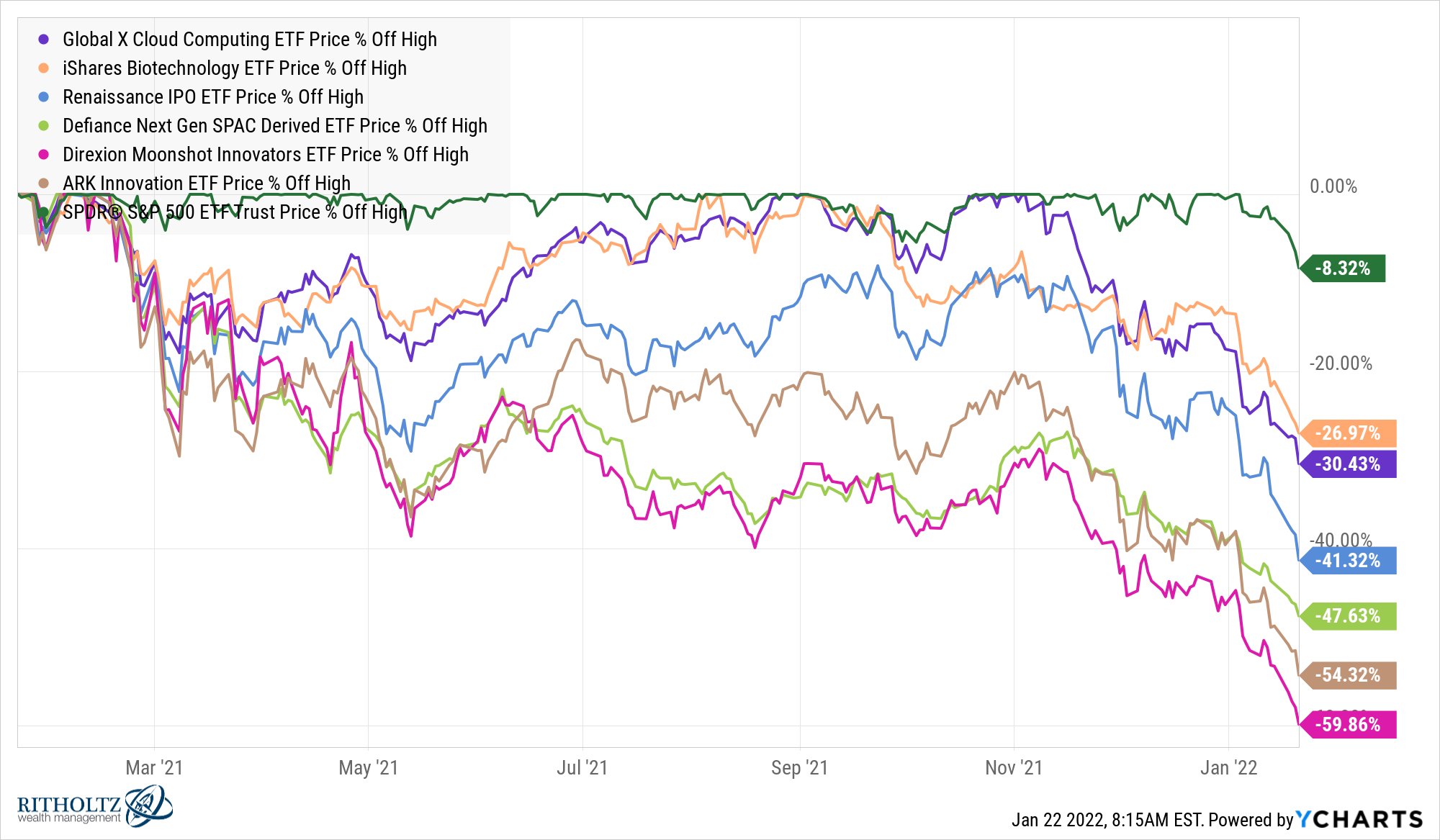

The current environment of a correction in the overall stock market while certain areas of the market are getting absolutely slaughtered has been gnawing at me for weeks like an actor in a movie I just can’t place.

Why does this market feel so familiar to a time I’ve read about in the past?

And then it hit me.

Oh yeah, this is basically the end of the Go-Go Years of the 1960s!

Obviously, I was not alive during the Go-Go Years of the 1960s or its aftermath but I have read the best book about that period, The Go-Go Years, by the inimitable John Brooks.

The Go-Go Years was a period that was defined by growth stock outperformance, millions of new retail investors, tons of speculation and star portfolio managers who were raking in the money based on extraordinary performance numbers.

Sound familiar?

When things finally fell apart the overall stock market went into a nasty bear market, down 36%, but the hottest stocks were drilled more like 80%. Brooks explains: