Bubble? What another bubble?

I’m in the camp that every correction is healthy if you’re someone who is still saving money. Down markets are a good thing because they allow you to average in at lower prices and higher yields. And whether down markets are good for you or not, they’re a feature of the stock market.

Capital Thinking · Issue #783 · View online

Figuring out the greatest bubble in history is like asking someone who their favorite child is.

I go back and forth between the South Sea Bubble and 1980s Japan.

The Defining Trait of All Bubbles: The Willful Suspension of Disbelief

Ben Carlson | A Wealth of Common Sense:

The stats from Japan in the 1980s seem to defy the financial laws of gravity:

- Japan made up 15% of world stock markets in 1980. By 1989 it represented 42% of the global equity markets.1

- From 1970-1989, Japanese large cap companies were up more than 22% per year. Small caps were up closer to 30% per year. For 20 years!

- Stocks went from 29% of Japan’s GDP in 1980 to 151% by 1989.

- By 1990 the Japanese real estate market was valued at 4x the value of real estate in the United States, despite being 25x smaller in terms of landmass and having 200 million fewer people.

- Tokyo itself was on equal footing with the U.S. in terms of real estate values.

- The Imperial Palace in Japan was being valued as much as the entire real estate market of Canada.

Japan was trading at a CAPE ratio of nearly 100x which is more than double what the U.S. was trading at during the height of the dot-com bubble. So the stock market was out of control.

But the real estate madness is even more interesting to me because real estate touches so many other aspects of the economy — banks, households, institutional investors, etc.

The biggest reason there was such a hangover in so many parts of our economy following the 2008 debacle is because the housing market was so heavily involved.

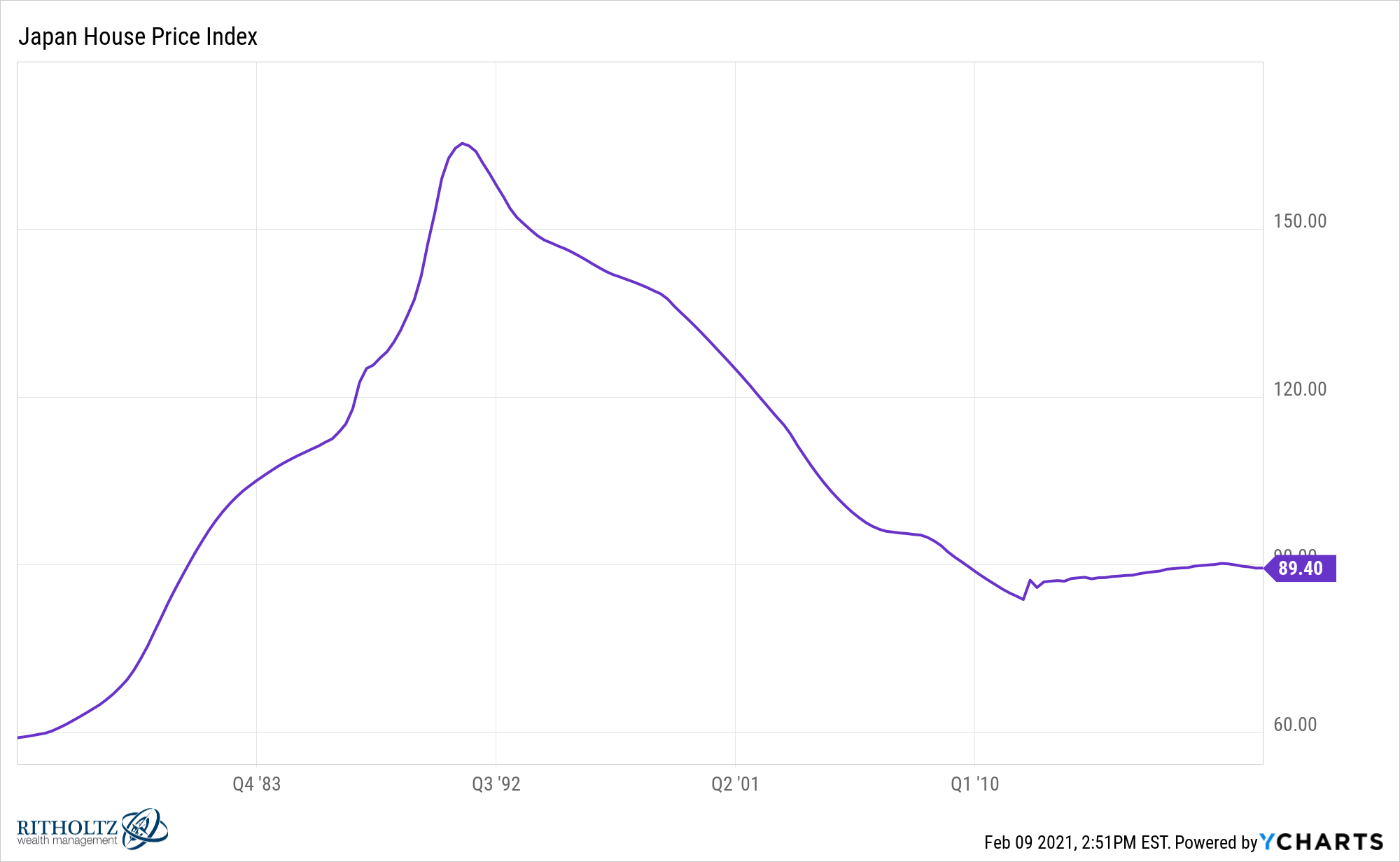

Of course, Isaac Newton showed up eventually, as you can see from Japan’s housing market ever since:

Housing prices in Japan remain down nearly 50% from that late-1980s peak more than 30 years later.

How could these prices possibly ever get so out of whack with reality?

I’m not good at market predictions because predicting the future is hard.

I’m in the camp that every correction is healthy if you’re someone who is still saving money. Down markets are a good thing because they allow you to average in at lower prices and higher yields.

And whether down markets are good for you or not, they’re a feature of the stock market.

But it feels like now more than ever a healthy correction is sorely needed before things get out of hand.

It’s way too easy to make money right now.

If this continues things could get out of hand.And then people would see what an actual bubble looks like.

*Feature post photo credit: Bence Halmosi on Unsplash