Advertising - Waves of Change

The obvious story is the collapse of print and the growth of internet, but more interesting to me is the decline of the top line: US advertising has shrunk by a third as a share of GDP.

Capital Thinking • Issue #1110 • View online

Amazon’s ad business is bigger than YouTube and more profitable than AWS. Shein is the biggest fast-fashion retailer in the US, with no stores.

US pay TV subscribers have fallen by a third. Where do ad budgets go, where does rent go, and how many brands will there be?

TV, merchant media and the unbundling of advertising

About five years ago, a revenue line buried in the back of Amazon's accounts started to get quite big. ‘Other revenue’ was over $4bn by the end of 2017, and if you looked at the notes to the notes, you discovered that this was ‘primarily’ advertising.

By 2019 this had grown to $14bn, and I wrote about it here, pointing out that ‘Amazon’ was no longer just e-commerce and AWS, and had become a bundle of lots of different businesses, many of which were probably just as profitable as AWS.

However, we still didn’t know exactly what ‘primarily’ meant. At the end of 2021 this changed: Amazon started splitting out the ad revenue directly, telling us that this is now a $31bn business.

$31bn is roughly the same size as Google Display, YouTube, or the entire global newspaper industry’s ad business.

This is only about 6.5% of Amazon’s net revenue, but it has much higher margins.

Google’s ad business has close to 60% operating margins excluding TAC; Amazon’s ads should be higher margin, given that it’s mostly leveraging the core businesses’s existing cost base (in other words - this is ‘found money’), but even assuming the same 60%, that would be $18bn of operating income in 2021, almost exactly the same as the $18.5bn that Amazon reports for AWS.

Given AWS’s capex requirements, this makes it extremely likely that the ad business produces more cashflow.

The difference in margin between e-commerce and advertising has become a much bigger story than Amazon: everyone from Uber to Walmart to Instacart is pushing into ‘merchant media’, and hiring at scale:

- Digital store fronts and apps can be ad inventory. There’s no a priori reason why you can only show ads next to ‘content’ - an ad in a physical store is not the same as an ad in magazine, but apps are apps.

- Many of these brands (eg Instacart) sit far down the purchasing funnel and so can sell very specific ads directly to brands…

- But even if they don't (eg Uber) they still have all sorts of first party data that comes with some form of privacy consent, which makes it valuable in itself, but much more valuable as we go through the ‘cookie apocalypse’ and remake how online targeting is going to work.

- And, of course, the margin differential means that ad revenue that’s a small percentage of the top line might have much larger impact on the bottom line. At least, until everyone else tries the same…

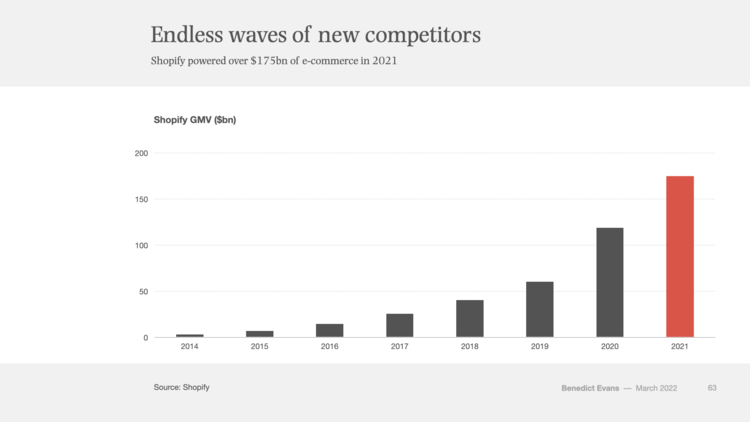

A big missing piece here, of course, is Shopify, which has built a $175bn GMV business in much the same period as Amazon advertising.

$175bn of GMV makes Shopify roughly 45% of the size of Amazon Marketplace. This is an interesting issue for competition regulators, since Shopify is not a consumer-facing brand and so a conventional market definition would say that it does not compete with Amazon - I doubt either company would agree.

Shopify’s big strategic question is how it can build network effects. It wants to sell higher-margin products to merchants for the money, but it might be more important in the long term that those products build a network, pull more merchants and users into the system, and make the core business more sticky.

Shop Pay is one building block, but an ad network would be another, combining data and inventory on one side (especially with Apple kneecapping SME advertising) and driving the underlying business on the other.

This would be an interesting comparison with Apple: Shopify would be a power player in advertising but wouldn’t (mainly) be doing it for the advertising.

Stepping back, though we should probably ask where all these ad budgets are coming from, and, more importantly, where the growth for internet advertising will come from next.

The obvious answer is television: print is mostly already gone, but ‘TV’ viewing is now finally unlocking, with US pay TV subscriptions now down by over a third.

UK 16-34s now watch more subscription streaming than all broadcaster content combined.

Where does all that inventory go, and where does all that budget go?

*Featured post photo by Arno Senoner on Unsplash