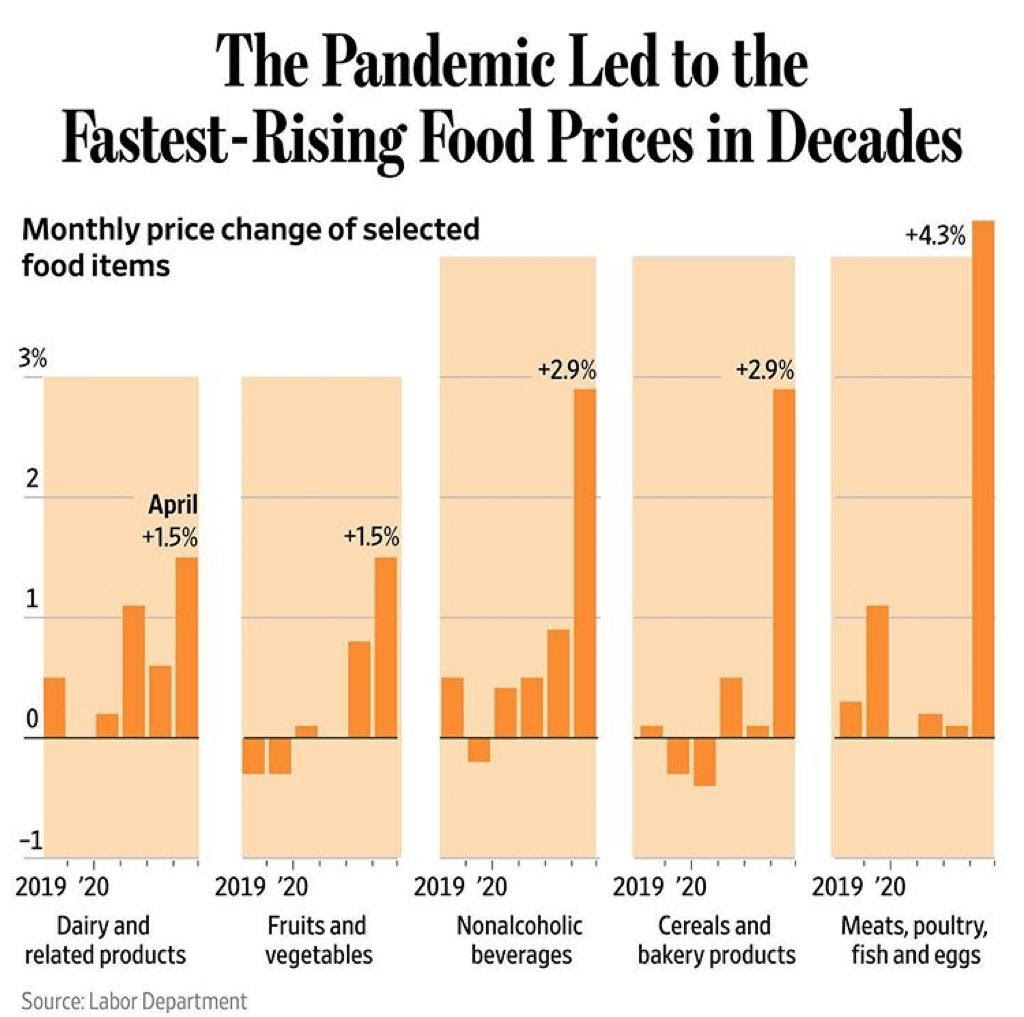

A Bad Case of the ESG's

The giant bubble in nonsense is slowly being unravelled and the places to allocate your capital are decidedly NOT where the chattering classes would have you believe. Do yourself a favour and think for yourself. Do the math and tell me it aint so.

Capital Thinking • Issue #621 • View online

“Things always become obvious after the fact”

― Nassim Nicholas Taleb

A Giant Bubble in Nonsense

Chris MacIntosh | Capitalist Exploits:

That’s what Eric Weinstein calls it.

To be more accurate:

“We are in the middle of a giant bubble of nonsense that is 50 years in the making in my estimation”

Speaking of nonsense I’ve previously discussed the ESG movement on this site. ESG stands for Environmental, Social and Governance.

It’s as if a bunch of folks who wear hemp clothes, sport dreadlocks and hug trees for a living built the financial marketing arm of Greta Thunberg.

ESG is the “solution” to the popular narrative championed by the hand wringing, teeth gnashing do gooders who profess to know how to solve the world’s ills, despite having never produced anything – ever!

Nassim Taleb calls them “Intellectual yet idiots”.

The idea perhaps, is to appeal to a new generation. Vegans.

Don’t argue..it is. And vegans we know are pale, have bad breath and are feeble.

And feeble is an accurate description of the premise behind many of these “ESG” funds popping up.

Certainly it’s a great funnel for horseshit companies to raise equity capital knowing that investors will be paying no attention to profitability short or long term, safe in the knowledge that mindless algos will order execute blocks of stock at any price since it’s all about “allocation” – fundamentals be damned.

If I could start a virtue signaling anti-cow-farting, save-the-planet company and get it into any of the increasing number of ESG funds out there I’d be assured of equity injections.

It wouldn’t even matter if I was running a slave operation.

Think I’m kidding?

Keep reading.

Here’s the ETF aptly named ESG.

Thus far it’s managed to dupe attract $7bn of AUM.

Why do I say that?

Because it’s all hogwash.

The equities making up this virtue signaling bucket of sick have nothing to do with making the world a better, more humane, healthier, safer place.

They are, instead, a mechanism much like carbon credits and driving a Tesla, of allowing an asinine idea to be executed on without actually doing anything at all yet allowing for the facade of doing something to exist.

This is an ETF designed for the social media mobs to virtue signal, and for spineless asset managers (yes you Blackrock) to acquiesce to the seething mob.

It’s a fortunate thing for iShares the underwriter, that the fact that the makeup of this thing makes no sense, doesn’t matter.

Nobody is interested in the facts. They’re only interested in dogma.

Take a look – one of its biggest holdings?

Amazon.

*Featured post photo by Kai Dahms on Unsplash