$200 Trillion Looking for a Home

If we assume a 10-15% real inflation rate going forward, half of the world’s wealth will evaporate within the next ten years.

By Capital Thinking • Issue #909 • View online

One of Warren Buffett many hidden quotes that stand out is:

“Rule Number One: Never lose money.

Rule Number Two: Never Forget Rule Number One”.

Half of the world’s wealth is about to lose most of its value

By Ras Vasilisin | Data Driven Investor:

Though one must not take Buffett literally, in this case, we’re seeing something interesting happening now.

More than half of the world’s wealth is about to lose 90% of its value.

Here’s what I mean.

Out of $400 trillion of total global financial assets, $200 trillion is invested in debt-denominated instruments or bonds.

If we assume a 10-15% real inflation rate going forward, half of the world’s wealth will evaporate within the next ten years.

For better or worse, bonds used to offer 5-6% return. If you assumed inflation was 1%, it’s understandable that you’d want to buy them. But that’s no longer the case.

100% guarantee to lose money

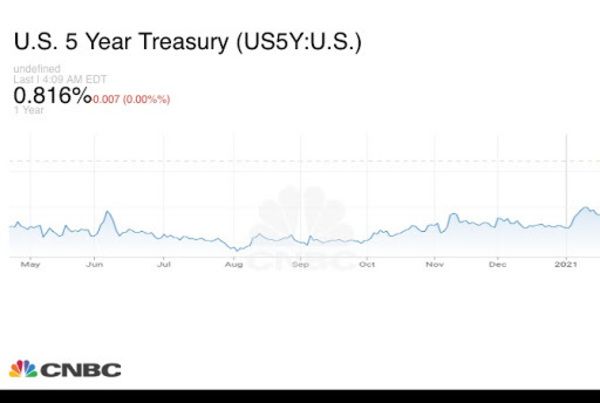

For illustration, if you lend your money to the US government by purchasing 5-year Treasury bonds, you get 0.8% a year.

Globaly, $16 trillion of bonds are now officially negative-yielding.

In other words, they are worth less than zero. Similarly, the remaining $185 trillion fixed-income assets are also negative-yielding if you consider the actual inflation rate of 10-15%.

To put this in perspective, if you lend someone money, they will return you less you gave them.

In other words, with bonds, you’re guaranteed to lose money.

What do legendary investors say?

It is undeniable that the world’s best investors are well aware of what’s happening.

- Superstar portfolio manager and CEO of ARK Invest, Cathie Wood, said you should “sell your bonds.”

- Warren Buffett’s outlook toward the global debt market has always been gloomy. However, recently he reaffirmed this view by saying, “bonds are not the place to be these days, and they retirees face a bleak future.”

- Founder of Bridgewater Associates, the worlds’ largest hedge fund, Ray Dalio, said investing in bonds has “become stupid.”

- And BlackRock, the world’s largest asset manager, is guiding its investors “not to put their money in bonds.”

They all know zero interest rates and endless money printing will trigger even higher inflation, and a $200 trillion of wealth will lose most of its value.

The definitions of insanity

There is no doubt money printing eventually leads to inflation and the debasement of currencies. We have many historical examples to back it up. Virtually all fiat currencies eventually go to zero.

Historically, there have been about 800 currencies worldwide, and all of them went to zero. There is no reason to believe that we will see any change to that. Our governments are running an experiment that has a proven result.

As Albert Einstein put it:

“The definition of insanity is doing the same thing over and over and expecting different results.”

$200 trillion is now looking for a place to go

Photo credit: Karsten Winegeart on Unsplash